Summary

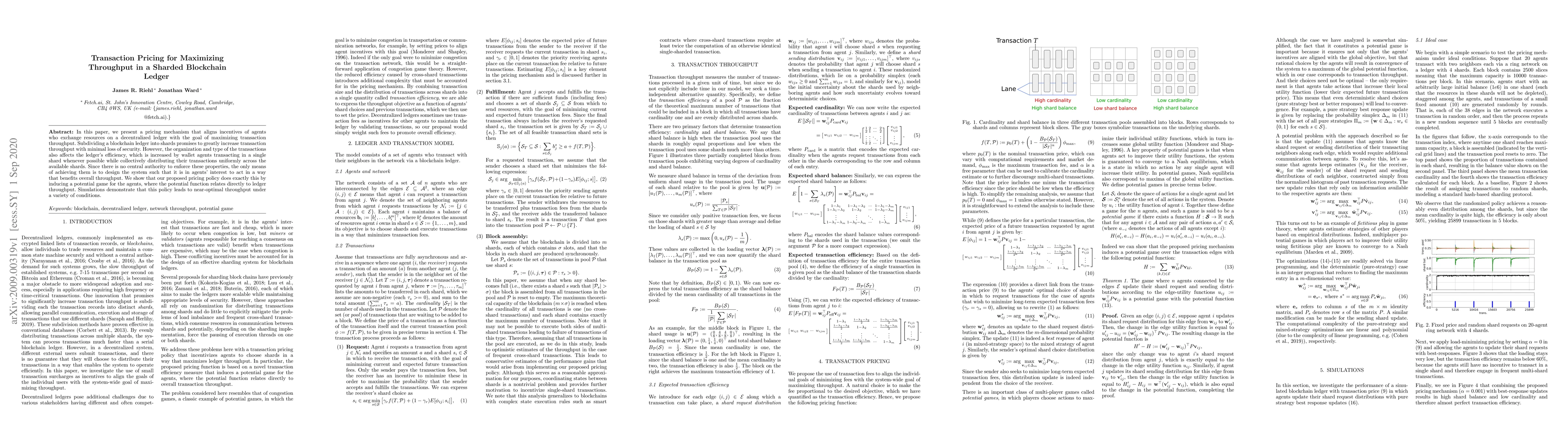

In this paper, we present a pricing mechanism that aligns incentives of agents who exchange resources on a decentralized ledger with the goal of maximizing transaction throughput. Subdividing a blockchain ledger into shards promises to greatly increase transaction throughput with minimal loss of security. However, the organization and type of the transactions also affects the ledger's efficiency, which is increased by wallet agents transacting in a single shard whenever possible while collectively distributing their transactions uniformly across the available shards. Since there is no central authority to enforce these properties, the only means of achieving them is to design the system such that it is in agents' interest to act in a way that benefits overall throughput. We show that our proposed pricing policy does exactly this by inducing a potential game for the agents, where the potential function relates directly to ledger throughput. Simulations demonstrate that this policy leads to near-optimal throughput under a variety of conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTxAllo: Dynamic Transaction Allocation in Sharded Blockchain Systems

Shirui Pan, Yuanzhe Zhang, Jiangshan Yu

Manifoldchain: Maximizing Blockchain Throughput via Bandwidth-Clustered Sharding

Xuechao Wang, Songze Li, Chunjiang Che

| Title | Authors | Year | Actions |

|---|

Comments (0)