Authors

Summary

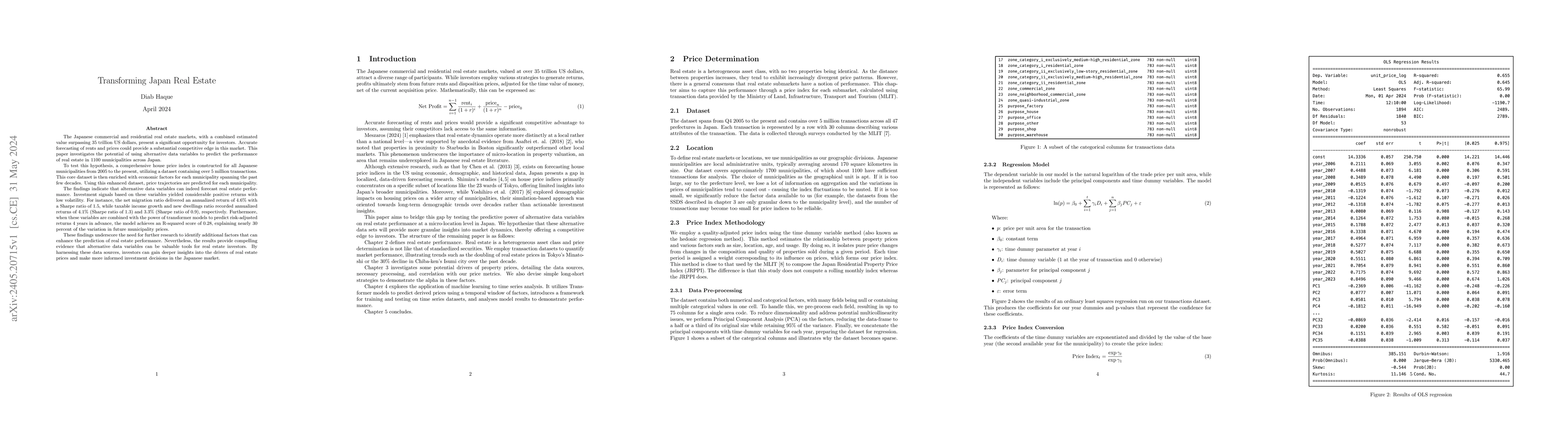

The Japanese real estate market, valued over 35 trillion USD, offers significant investment opportunities. Accurate rent and price forecasting could provide a substantial competitive edge. This paper explores using alternative data variables to predict real estate performance in 1100 Japanese municipalities. A comprehensive house price index was created, covering all municipalities from 2005 to the present, using a dataset of over 5 million transactions. This core dataset was enriched with economic factors spanning decades, allowing for price trajectory predictions. The findings show that alternative data variables can indeed forecast real estate performance effectively. Investment signals based on these variables yielded notable returns with low volatility. For example, the net migration ratio delivered an annualized return of 4.6% with a Sharpe ratio of 1.5. Taxable income growth and new dwellings ratio also performed well, with annualized returns of 4.1% (Sharpe ratio of 1.3) and 3.3% (Sharpe ratio of 0.9), respectively. When combined with transformer models to predict risk-adjusted returns 4 years in advance, the model achieved an R-squared score of 0.28, explaining nearly 30% of the variation in future municipality prices. These results highlight the potential of alternative data variables in real estate investment. They underscore the need for further research to identify more predictive factors. Nonetheless, the evidence suggests that such data can provide valuable insights into real estate price drivers, enabling more informed investment decisions in the Japanese market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDynamic Pricing for Real Estate

Lev Razumovskiy, Mariya Gerasimova, Nikolay Karenin

No citations found for this paper.

Comments (0)