Summary

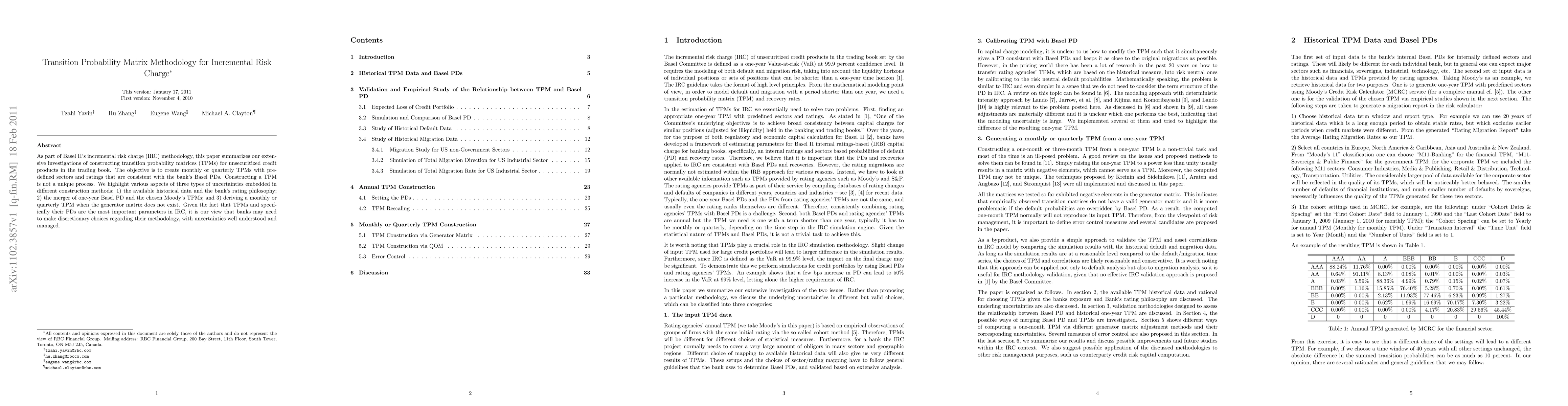

As part of Basel II's incremental risk charge (IRC) methodology, this paper summarizes our extensive investigations of constructing transition probability matrices (TPMs) for unsecuritized credit products in the trading book. The objective is to create monthly or quarterly TPMs with predefined sectors and ratings that are consistent with the bank's Basel PDs. Constructing a TPM is not a unique process. We highlight various aspects of three types of uncertainties embedded in different construction methods: 1) the available historical data and the bank's rating philosophy; 2) the merger of one-year Basel PD and the chosen Moody's TPMs; and 3) deriving a monthly or quarterly TPM when the generator matrix does not exist. Given the fact that TPMs and specifically their PDs are the most important parameters in IRC, it is our view that banks may need to make discretionary choices regarding their methodology, with uncertainties well understood and managed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBeyond probability-impact matrices in project risk management: A quantitative methodology for risk prioritisation

Fernando Acebes, Javier Pajares, José Manuel González-Varona et al.

SmartDelta Methodology: Automated Quality Assurance and Optimization for Incremental System Engineering

Eray Tüzün, Nicolas Bonnotte, Robin Gröpler et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)