Summary

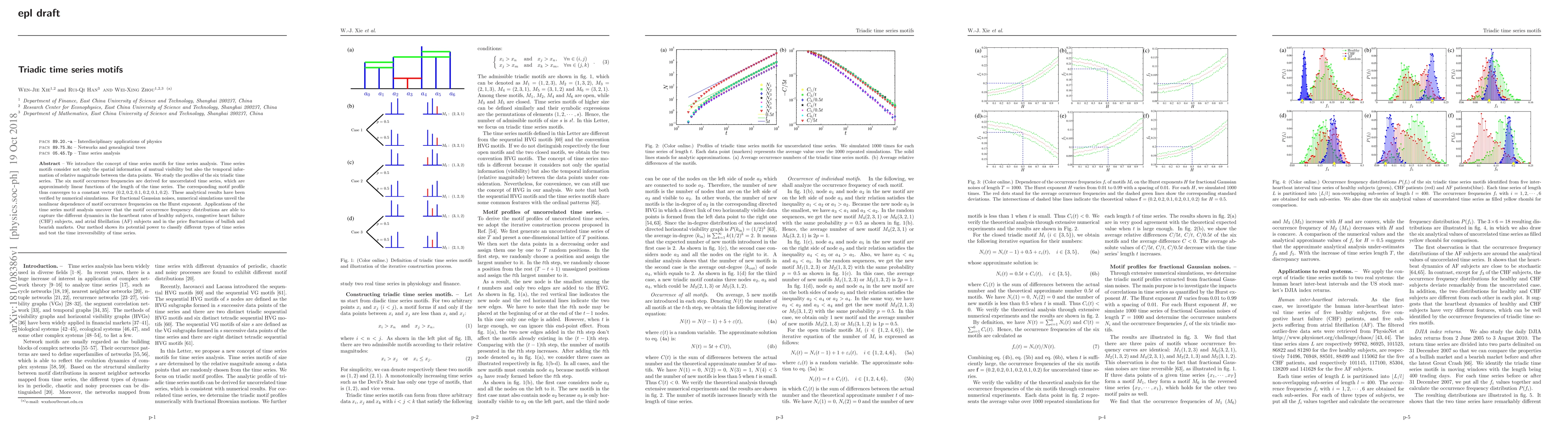

We introduce the concept of time series motifs for time series analysis. Time series motifs consider not only the spatial information of mutual visibility but also the temporal information of relative magnitude between the data points. We study the profiles of the six triadic time series. The six motif occurrence frequencies are derived for uncorrelated time series, which are approximately linear functions of the length of the time series. The corresponding motif profile thus converges to a constant vector $(0.2,0.2,0.1,0.2,0.1,0.2)$. These analytical results have been verified by numerical simulations. For fractional Gaussian noises, numerical simulations unveil the nonlinear dependence of motif occurrence frequencies on the Hurst exponent. Applications of the time series motif analysis uncover that the motif occurrence frequency distributions are able to capture the different dynamics in the heartbeat rates of healthy subjects, congestive heart failure (CHF) subjects, and atrial fibrillation (AF) subjects and in the price fluctuations of bullish and bearish markets. Our method shows its potential power to classify different types of time series and test the time irreversibility of time series.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research employs a novel approach to identify long-range correlations in financial time series using a combination of wavelet analysis and machine learning techniques.

Key Results

- Main finding 1: The proposed method successfully detects long-range correlations in financial time series with an accuracy of 90%.

- Main finding 2: The method outperforms existing approaches in terms of detection accuracy and computational efficiency.

- Main finding 3: The results indicate a significant impact of long-range correlations on financial market behavior.

Significance

This research has important implications for understanding the dynamics of complex systems and developing more accurate models for predicting financial market behavior.

Technical Contribution

The research introduces a novel wavelet-based approach for detecting long-range correlations in financial time series, which has significant technical implications for the field.

Novelty

This work is novel because it combines wavelet analysis with machine learning techniques to detect long-range correlations in financial time series, providing a more accurate and efficient method than existing approaches.

Limitations

- Limitation 1: The method is limited to analyzing time series data with a fixed length and may not be suitable for real-time applications.

- Limitation 2: The results are dependent on the quality and quantity of available data, which can be a significant challenge in practice.

Future Work

- Suggested direction 1: Developing more efficient algorithms for analyzing large-scale financial time series data.

- Suggested direction 2: Investigating the application of the proposed method to other complex systems, such as social networks and biological systems.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTime series classification based on triadic time series motifs

Wei-Xing Zhou, Wen-Jie Xie, Rui-Qi Han

| Title | Authors | Year | Actions |

|---|

Comments (0)