Summary

With the rapidly growing demand for the cloud services, a need for efficient methods to trade computing resources increases. Commonly used fixed-price model is not always the best approach for trading cloud resources, because of its inflexible and static nature. Dynamic trading systems, which make use of market mechanisms, show promise for more efficient resource allocation and pricing in the cloud. However, most of the existing mechanisms ignore the seller's costs of providing the resources. In order to address it, we propose a single-sided market mechanism for trading virtual machine instances in the cloud, where the cloud provider can express the reservation prices for traded cloud services. We investigate the theoretical properties of the proposed mechanism and prove that it is truthful, i.e. the buyers do not have an incentive to lie about their true valuation of the resources. We perform extensive experiments in order to investigate the impact of the reserve price on the market outcome. Our experiments show that the proposed mechanism yields near optimal allocations and has a low execution time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

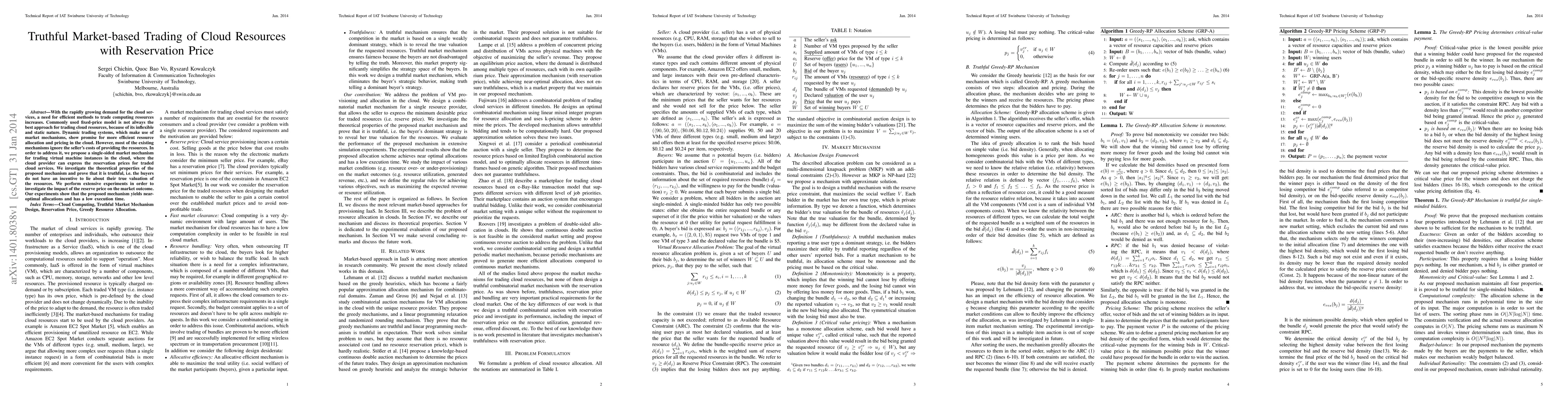

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)