Summary

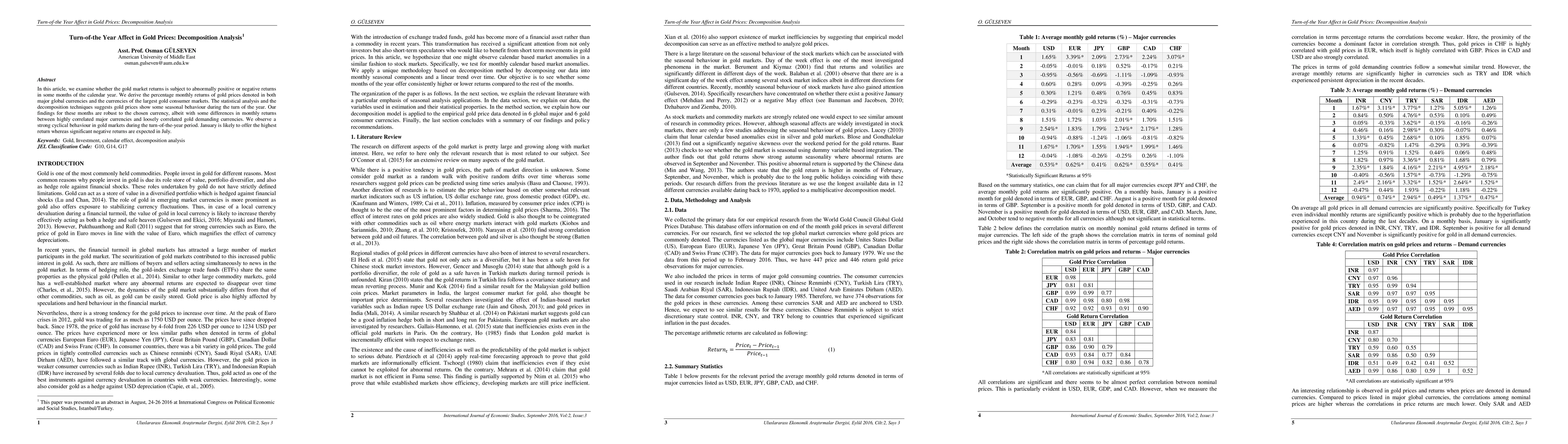

In this article, we examine whether the gold market returns show abnormally positive or negative returns in some months of the calendar year. The statistical analysis and the decomposition techniques suggest that gold prices show some seasonal behavior during the turn of the year. We observe a strong cyclical behavior in gold markets during the turn-of-the-year period. January is likely to offer the highest return whereas significant negative returns are expected in July.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersImpact of Gold Prices on Stock Exchange: An Empirical Case Study of Nepal

Aneel Bhusal, Madhu Sudan Gautam

Does Noise Affect Housing Prices? A Case Study in the Urban Area of Thessaloniki

Grigorios Tsoumakas, Dimitris Vrakas, Georgios Kamtziridis

| Title | Authors | Year | Actions |

|---|

Comments (0)