Summary

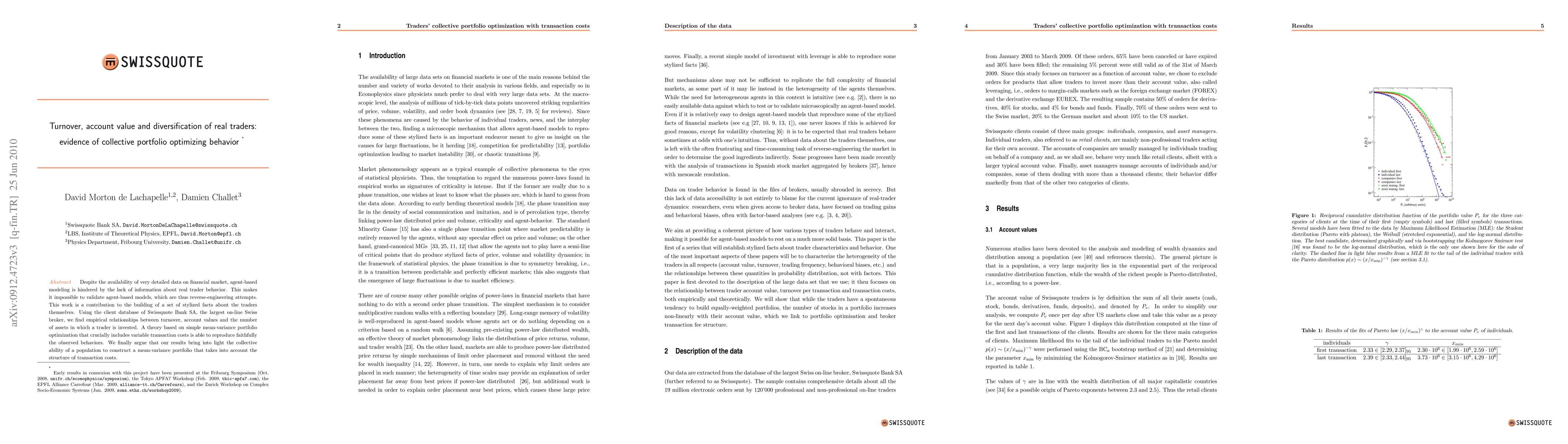

Despite the availability of very detailed data on financial market, agent-based modeling is hindered by the lack of information about real trader behavior. This makes it impossible to validate agent-based models, which are thus reverse-engineering attempts. This work is a contribution to the building of a set of stylized facts about the traders themselves. Using the client database of Swissquote Bank SA, the largest on-line Swiss broker, we find empirical relationships between turnover, account values and the number of assets in which a trader is invested. A theory based on simple mean-variance portfolio optimization that crucially includes variable transaction costs is able to reproduce faithfully the observed behaviors. We finally argue that our results bring into light the collective ability of a population to construct a mean-variance portfolio that takes into account the structure of transaction costs

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)