Summary

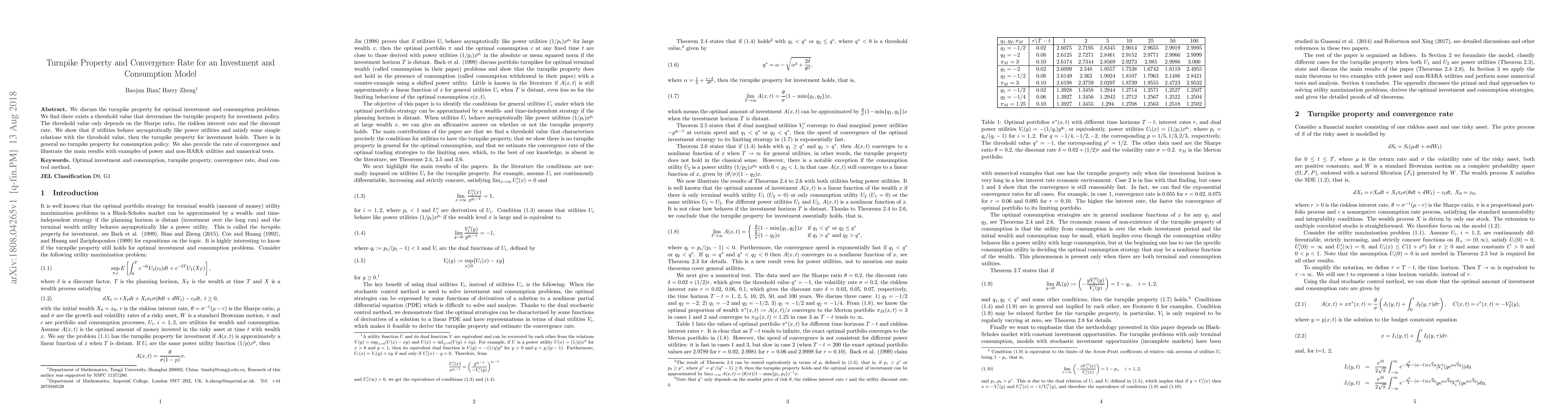

We discuss the turnpike property for optimal investment and consumption problems. We find there exists a threshold value that determines the turnpike property for investment policy. The threshold value only depends on the Sharpe ratio, the riskless interest rate and the discount rate. We show that if utilities behave asymptotically like power utilities and satisfy some simple relations with the threshold value, then the turnpike property for investment holds. There is in general no turnpike property for consumption policy. We also provide the rate of convergence and illustrate the main results with examples of power and non-HARA utilities and numerical tests.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)