Summary

There is a general consensus of the good sensing and novelty characteristics of Twitter as an information media for the complex financial market. This paper investigates the permeability of Twittersphere, the total universe of Twitter users and their habits, towards relevant events in the financial market. Analysis shows that a general purpose social media is permeable to financial-specific events and establishes Twitter as a relevant feeder for taking decisions regarding the financial market and event fraudulent activities in that market. However, the provenance of contributions, their different levels of credibility and quality and even the purpose or intention behind them should to be considered and carefully contemplated if Twitter is used as a single source for decision taking. With the overall aim of this research, to deploy an architecture for real-time monitoring of irregularities in the financial market, this paper conducts a series of experiments on the level of permeability and the permeable features of Twitter in the event of one of these irregularities. To be precise, Twitter data is collected concerning an event comprising of a specific financial action on the 27th January 2017:{~ }the announcement about the merge of two companies Tesco PLC and Booker Group PLC, listed in the main market of the London Stock Exchange (LSE), to create the UK's Leading Food Business. The experiment attempts to answer five key research questions which aim to characterize the features of Twitter permeability to the financial market. The experimental results confirm that a far-impacting financial event, such as the merger considered, caused apparent disturbances in all the features considered, that is, information volume, content and sentiment as well as geographical provenance. Analysis shows that despite, Twitter not being a specific financial forum, it is permeable to financial events.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

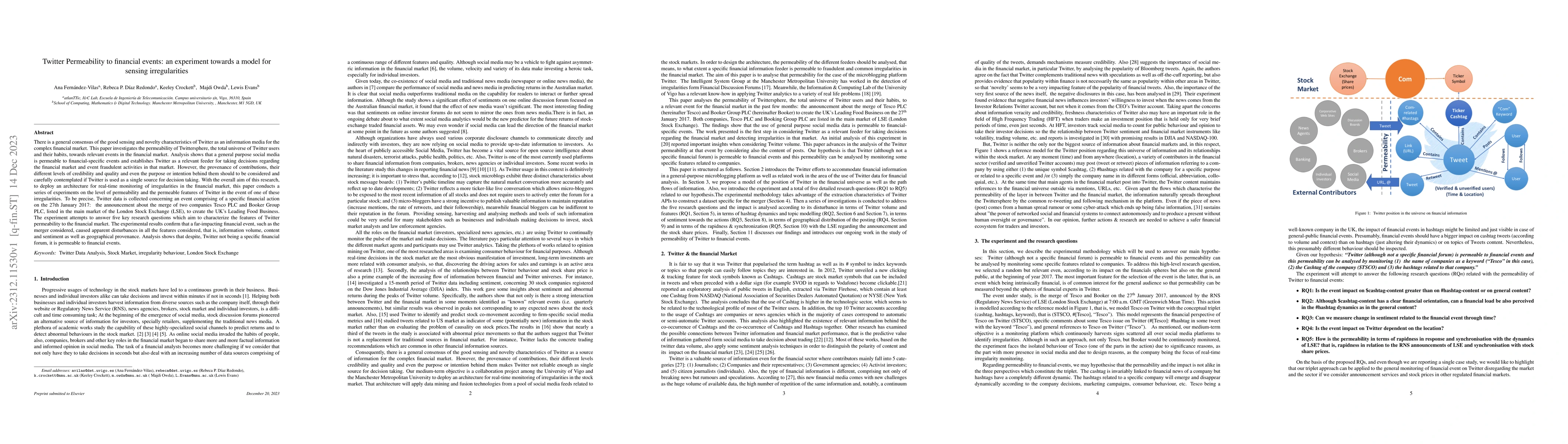

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTBAM: Towards An Agent-Based Model to Enrich Twitter Data

Usman Anjum, Prashant Krishnamurthy, Vladimir Zadorozhny

Using Twitter Data to Determine Hurricane Category: An Experiment

Songhui Yue, Randy K. Smith, Jyothsna Kondari et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)