Summary

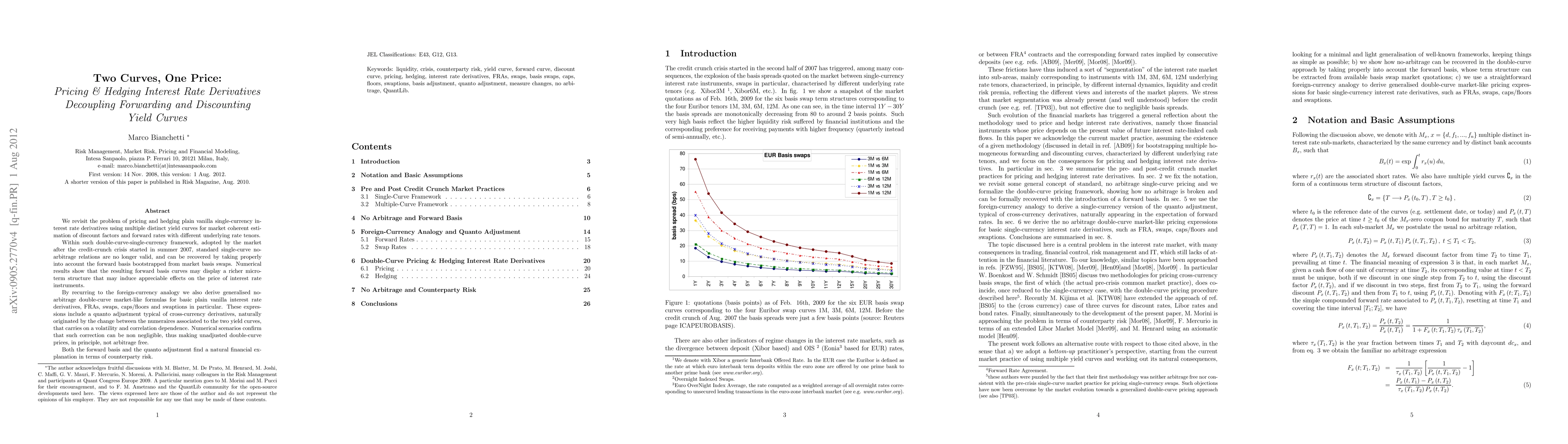

We revisit the problem of pricing and hedging plain vanilla single-currency interest rate derivatives using multiple distinct yield curves for market coherent estimation of discount factors and forward rates with different underlying rate tenors. Within such double-curve-single-currency framework, adopted by the market after the credit-crunch crisis started in summer 2007, standard single-curve no-arbitrage relations are no longer valid, and can be recovered by taking properly into account the forward basis bootstrapped from market basis swaps. Numerical results show that the resulting forward basis curves may display a richer micro-term structure that may induce appreciable effects on the price of interest rate instruments. By recurring to the foreign-currency analogy we also derive generalised no-arbitrage double-curve market-like formulas for basic plain vanilla interest rate derivatives, FRAs, swaps, caps/floors and swaptions in particular. These expressions include a quanto adjustment typical of cross-currency derivatives, naturally originated by the change between the numeraires associated to the two yield curves, that carries on a volatility and correlation dependence. Numerical scenarios confirm that such correction can be non negligible, thus making unadjusted double-curve prices, in principle, not arbitrage free. Both the forward basis and the quanto adjustment find a natural financial explanation in terms of counterparty risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)