Authors

Summary

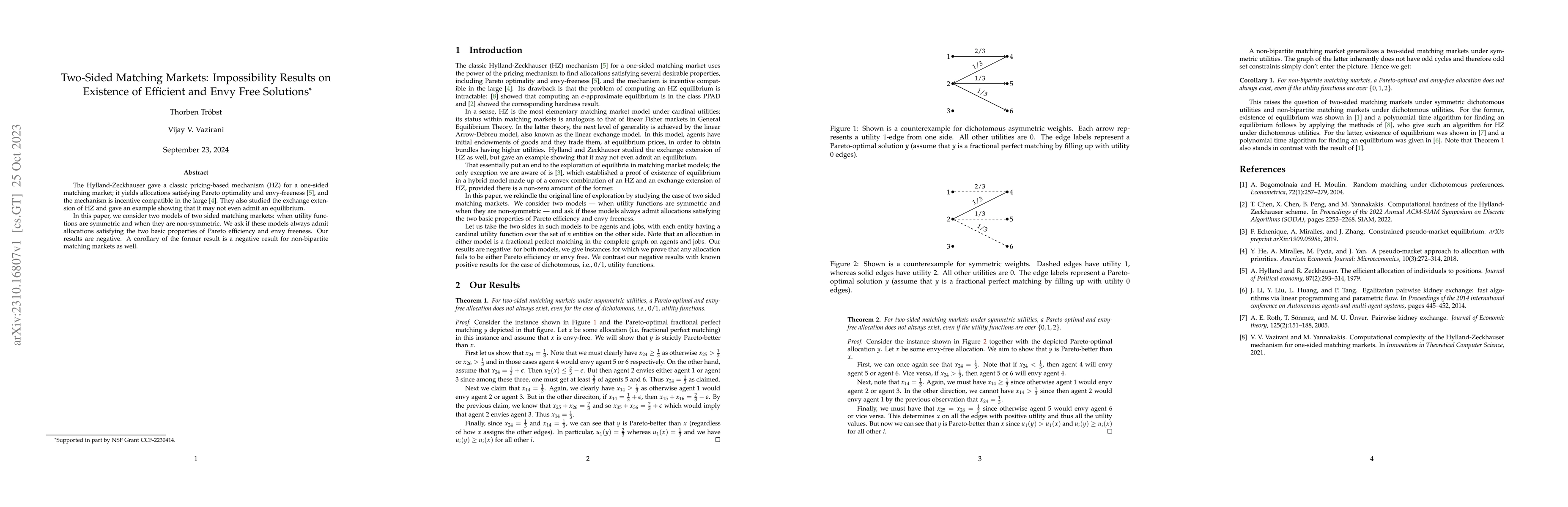

The Hylland-Zeckhauser gave a classic pricing-based mechanism (HZ) for a one-sided matching market; it yields allocations satisfying Pareto optimality and envy-freeness (Hylland and Zeckhauser, 1979), and the mechanism is incentive compatible in the large (He et al., 2018). They also studied the exchange extension of HZ and gave an example showing that it may not even admit an equilibrium. In this paper, we consider two models of two sided matching markets: when utility functions are symmetric and when they are non-symmetric. We ask if these models always admit allocations satisfying the two basic properties of Pareto efficiency and envy freeness. Our results are negative. A corollary of the former result is a negative result for non-bipartite matching markets as well.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Similar Papers

Found 4 papersCardinal-Utility Matching Markets: The Quest for Envy-Freeness, Pareto-Optimality, and Efficient Computability

Thorben Tröbst, Vijay V. Vazirani

Efficient Two-Sided Markets with Limited Information

Paul Dütting, Federico Fusco, Stefano Leonardi et al.

No citations found for this paper.

Comments (0)