Summary

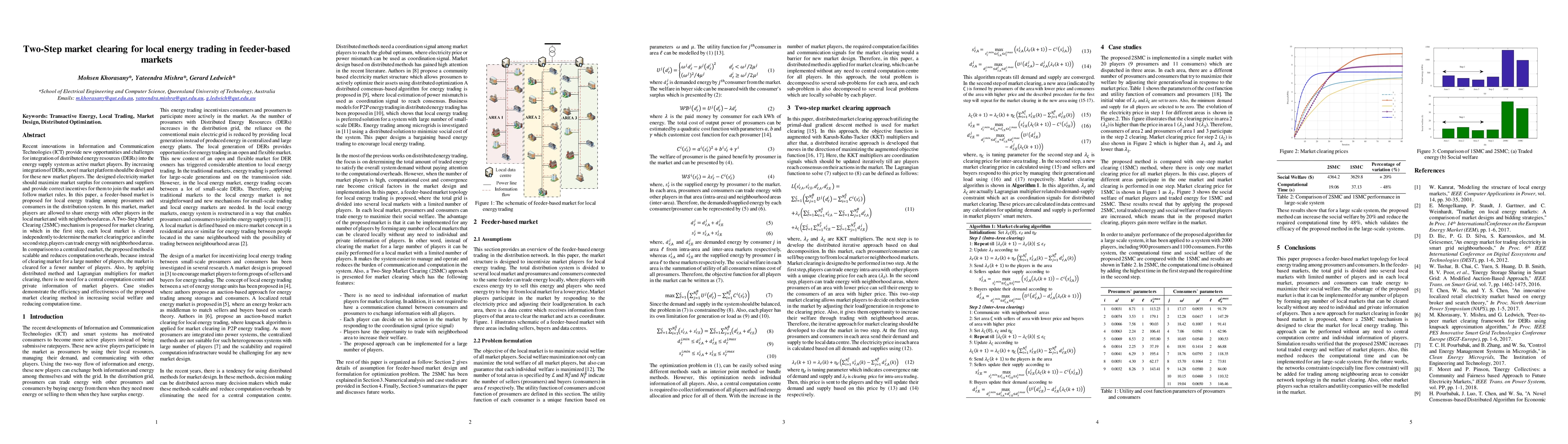

Recent innovations in Information and Communication Technologies (ICT) provide new opportunities and challenges for integration of distributed energy resources (DERs) into the energy supply system as active market players. By increasing integration of DERs, novel market platform should be designed for these new market players. The designed electricity market should maximize market surplus for consumers and suppliers and provide correct incentives for them to join the market and follow market rules. In this paper, a feeder-based market is proposed for local energy trading among prosumers and consumers in the distribution system. In this market, market players are allowed to share energy with other players in the local market and with neighborhood areas. A Two-StepMarket Clearing (2SMC) mechanism is proposed for market clearing, in which in the first step, each local market is cleared independently to determine the market clearing price and in the second step, players can trade energy with neighborhood areas. In comparison to a centralized market, the proposed method is scalable and reduces computation overheads, because instead of clearing market for a large number of players, the market is cleared for a fewer number of players. Also, by applying distributed method and Lagrangian multipliers for market clearing, there is no need for a central computation centre and private information of market players. Case studies demonstrate the efficiency and effectiveness of the proposed market clearing method in increasing social welfare and reducing computation time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Market Mechanism for Trading Flexibility Between Interconnected Electricity Markets

Alfredo Garcia, Ceyhun Eksin, Roohallah Khatami et al.

A Flow-based Distributed Trading Mechanism in Regional Electricity Market with Energy Hub

Lu Wang, Rachid Cherkaoui, Mokhtar Bozorg et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)