Summary

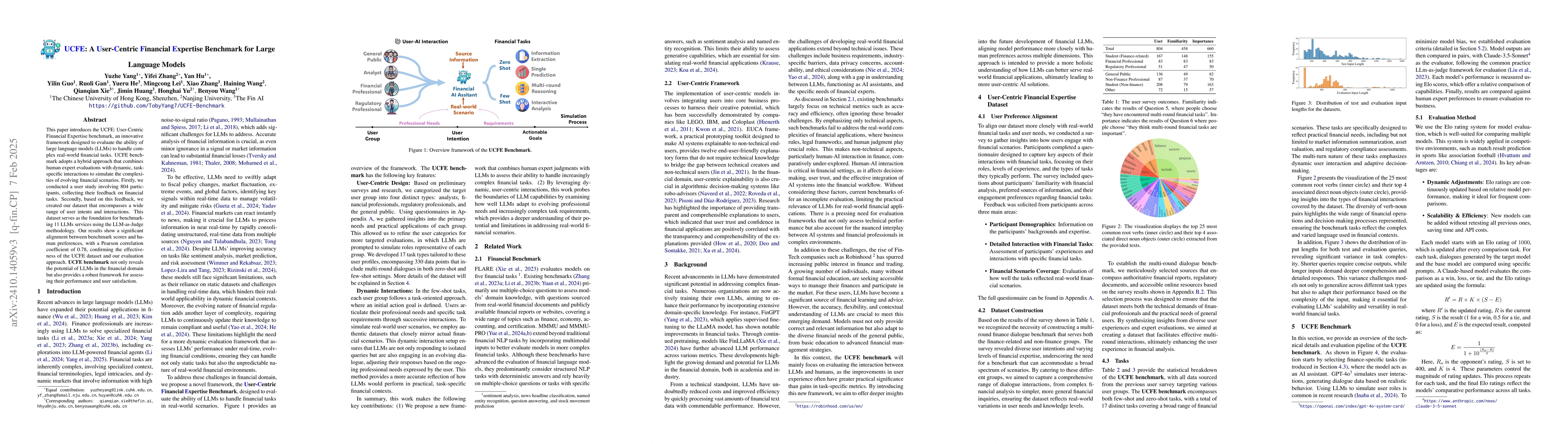

This paper introduces the UCFE: User-Centric Financial Expertise benchmark, an innovative framework designed to evaluate the ability of large language models (LLMs) to handle complex real-world financial tasks. UCFE benchmark adopts a hybrid approach that combines human expert evaluations with dynamic, task-specific interactions to simulate the complexities of evolving financial scenarios. Firstly, we conducted a user study involving 804 participants, collecting their feedback on financial tasks. Secondly, based on this feedback, we created our dataset that encompasses a wide range of user intents and interactions. This dataset serves as the foundation for benchmarking 12 LLM services using the LLM-as-Judge methodology. Our results show a significant alignment between benchmark scores and human preferences, with a Pearson correlation coefficient of 0.78, confirming the effectiveness of the UCFE dataset and our evaluation approach. UCFE benchmark not only reveals the potential of LLMs in the financial sector but also provides a robust framework for assessing their performance and user satisfaction.The benchmark dataset and evaluation code are available.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA User-Centric Benchmark for Evaluating Large Language Models

Min Zhang, Fengran Mo, Jian-Yun Nie et al.

Data-Centric Financial Large Language Models

Hong Chen, Xin Lu, Jun Zhou et al.

Golden Touchstone: A Comprehensive Bilingual Benchmark for Evaluating Financial Large Language Models

Jia Li, Chengjin Xu, Yiyan Qi et al.

No citations found for this paper.

Comments (0)