Summary

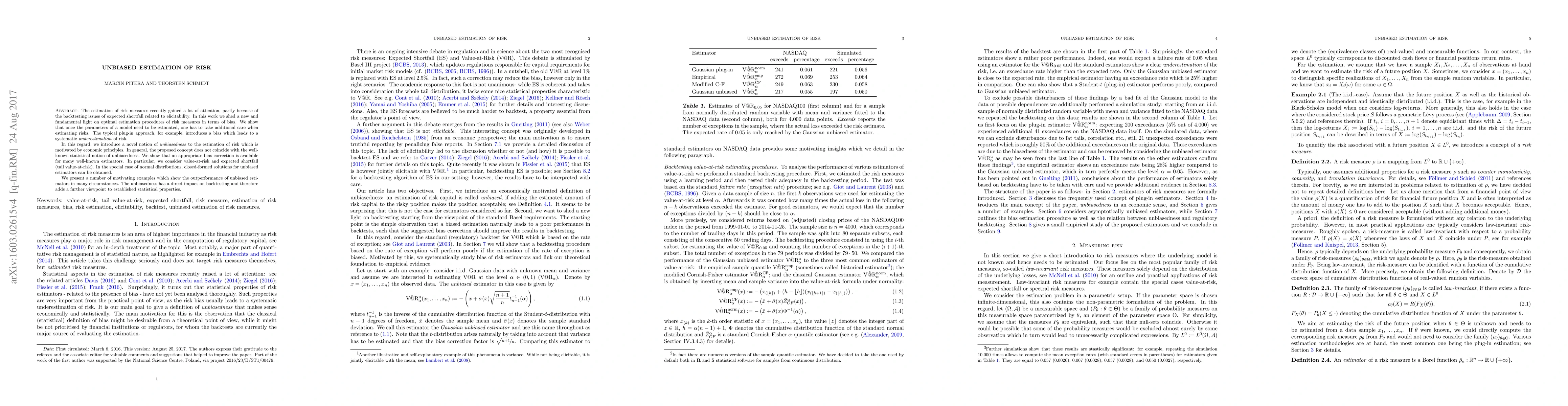

The estimation of risk measures recently gained a lot of attention, partly because of the backtesting issues of expected shortfall related to elicitability. In this work we shed a new and fundamental light on optimal estimation procedures of risk measures in terms of bias. We show that once the parameters of a model need to be estimated, one has to take additional care when estimating risks. The typical plug-in approach, for example, introduces a bias which leads to a systematic underestimation of risk. In this regard, we introduce a novel notion of unbiasedness to the estimation of risk which is motivated by economic principles. In general, the proposed concept does not coincide with the well-known statistical notion of unbiasedness. We show that an appropriate bias correction is available for many well-known estimators. In particular, we consider value-at-risk and expected shortfall (tail value-at-risk). In the special case of normal distributions, closed-formed solutions for unbiased estimators can be obtained. We present a number of motivating examples which show the outperformance of unbiased estimators in many circumstances. The unbiasedness has a direct impact on backtesting and therefore adds a further viewpoint to established statistical properties.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLow-rank matrix denoising for count data using unbiased Kullback-Leibler risk estimation

Jérémie Bigot, Charles Deledalle

| Title | Authors | Year | Actions |

|---|

Comments (0)