Summary

In this paper, we propose the uncertain volatility models with stochastic bounds. Like the regular uncertain volatility models, we know only that the true model lies in a family of progressively measurable and bounded processes, but instead of using two deterministic bounds, the uncertain volatility fluctuates between two stochastic bounds generated by its inherent stochastic volatility process. This brings better accuracy and is consistent with the observed volatility path such as for the VIX as a proxy for instance. We apply the regular perturbation analysis upon the worst case scenario price, and derive the first order approximation in the regime of slowly varying stochastic bounds. The original problem which involves solving a fully nonlinear PDE in dimension two for the worst case scenario price, is reduced to solving a nonlinear PDE in dimension one and a linear PDE with source, which gives a tremendous computational advantage. Numerical experiments show that this approximation procedure performs very well, even in the regime of moderately slow varying stochastic bounds.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

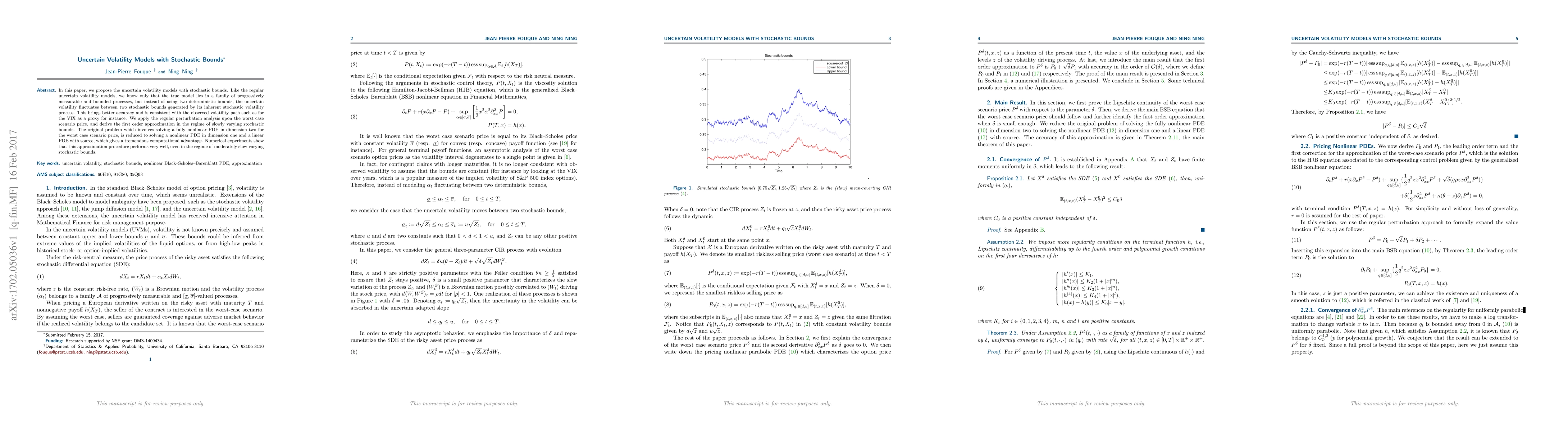

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic volatility models with skewness selection

Igor Ferreira Batista Martins, Hedibert Freitas Lopes

| Title | Authors | Year | Actions |

|---|

Comments (0)