Authors

Summary

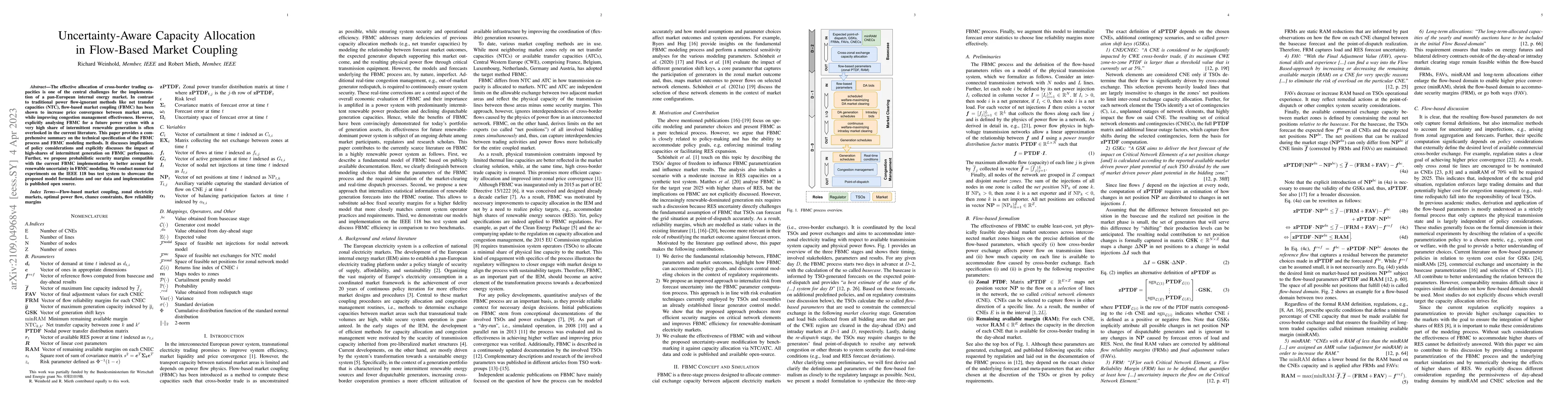

The effective allocation of cross-border trading capacities is one of the central challenges for the implementation of a pan-European internal energy market. In contrast to traditional power flow-ignorant methods like net transfer capacities (NTC), flow-based market coupling (FBMC) has been shown to increase price convergence between market areas, while improving congestion management effectiveness. However, explicitly analysing FBMC for a future power system with a very high share of intermittent renewable generation is often overlooked in the current literature. This paper provides a comprehensive summary on the technical specification of the FBMC process and FBMC modeling methods. It discusses implications of policy considerations and explicitly discusses the impact of high-shares of intermittent generation on FBMC performance. Further, we propose probabilistic security margins compatible with the current FBMC implementation to better account for renewable uncertainty in FBMC modeling. We conduct numerical experiments on the IEEE 118 bus test system to showcase the proposed model formulations and our data and implementation is published open source.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntroducing advanced hybrid coupling: Non-discriminatory coalescence of flow-based and net transfer capacity calculation regions

David Schönheit, Ivan Marjanović

| Title | Authors | Year | Actions |

|---|

Comments (0)