Summary

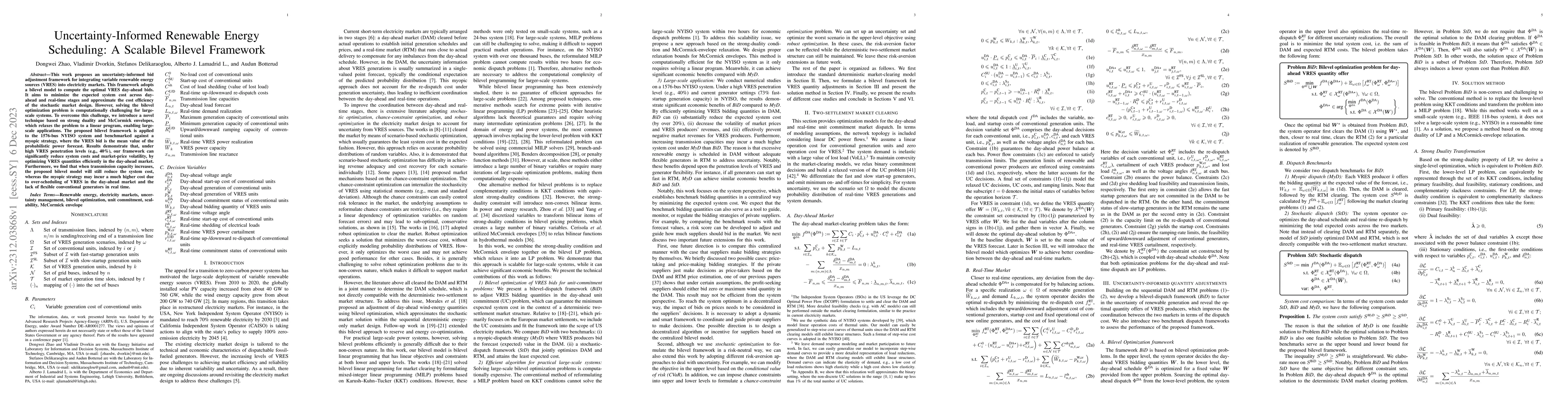

This work proposes an uncertainty-informed bid adjustment framework for integrating variable renewable energy sources (VRES) into electricity markets. This framework adopts a bilevel model to compute the optimal VRES day-ahead bids. It aims to minimize the expected system cost across day-ahead and real-time stages and approximate the cost efficiency of the stochastic market design. However, solving the bilevel optimization problem is computationally challenging for large-scale systems. To overcome this challenge, we introduce a novel technique based on strong duality and McCormick envelopes, which relaxes the problem to a linear program, enabling large-scale applications. The proposed bilevel framework is applied to the 1576-bus NYISO system and benchmarked against a myopic strategy, where the VRES bid is the mean value of the probabilistic power forecast. Results demonstrate that, under high VRES penetration levels (e.g., 40%), our framework can significantly reduce system costs and market-price volatility, by optimizing VRES quantities efficiently in the day-ahead market. Furthermore, we find that when transmission capacity increases, the proposed bilevel model will still reduce the system cost, whereas the myopic strategy may incur a much higher cost due to over-scheduling of VRES in the day-ahead market and the lack of flexible conventional generators in real time.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Scalable Bilevel Framework for Renewable Energy Scheduling

Vladimir Dvorkin, Audun Botterud, Dongwei Zhao et al.

A Robust Optimization Framework for Flexible Industrial Energy Scheduling: Application to a Cement Plant with Market Participation

Sebastián Rojas-Innocenti, Enrique Baeyens, Alejandro Martín-Crespo et al.

EASE: Energy-Aware Job Scheduling for Vehicular Edge Networks With Renewable Energy Resources

Ruggero Carli, Michele Rossi, Francesca Meneghello et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)