Summary

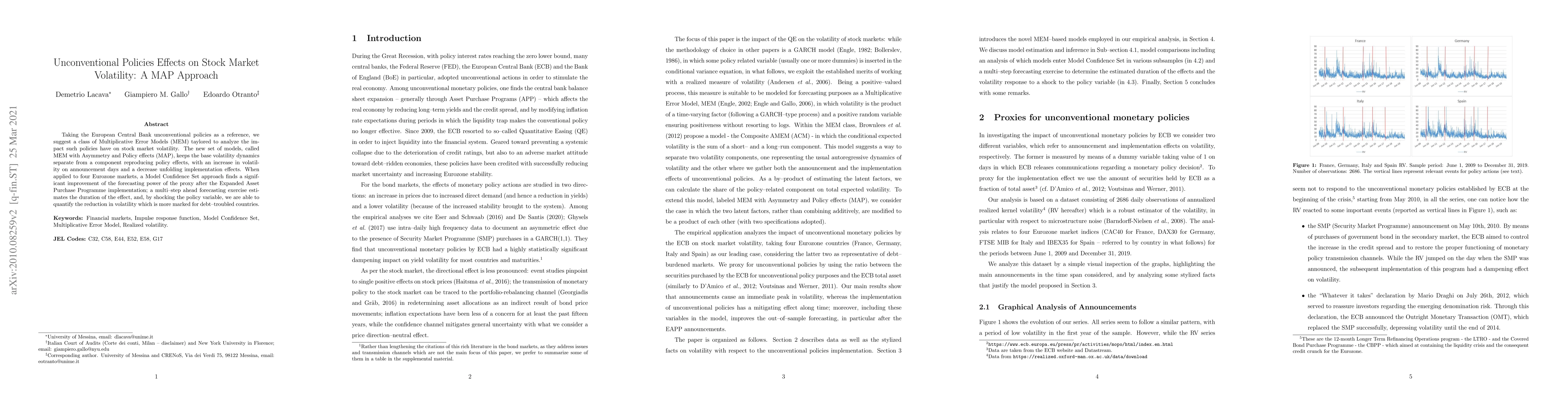

Taking the European Central Bank unconventional policies as a reference, we suggest a class of Multiplicative Error Models (MEM) taylored to analyze the impact such policies have on stock market volatility. The new set of models, called MEM with Asymmetry and Policy effects (MAP), keeps the base volatility dynamics separate from a component reproducing policy effects, with an increase in volatility on announcement days and a decrease unfolding implementation effects. When applied to four Eurozone markets, a Model Confidence Set approach finds a significant improvement of the forecasting power of the proxy after the Expanded Asset Purchase Programme implementation; a multi--step ahead forecasting exercise estimates the duration of the effect, and, by shocking the policy variable, we are able to quantify the reduction in volatility which is more marked for debt--troubled countries.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFrom Votes to Volatility Predicting the Stock Market on Election Day

Igor L. R. Azevedo, Toyotaro Suzumura

No citations found for this paper.

Comments (0)