Summary

We design a new nonparametric method that allows one to estimate the matrix of integrated kernels of a multivariate Hawkes process. This matrix not only encodes the mutual influences of each nodes of the process, but also disentangles the causality relationships between them. Our approach is the first that leads to an estimation of this matrix without any parametric modeling and estimation of the kernels themselves. A consequence is that it can give an estimation of causality relationships between nodes (or users), based on their activity timestamps (on a social network for instance), without knowing or estimating the shape of the activities lifetime. For that purpose, we introduce a moment matching method that fits the third-order integrated cumulants of the process. We show on numerical experiments that our approach is indeed very robust to the shape of the kernels, and gives appealing results on the MemeTracker database.

AI Key Findings

Generated Sep 05, 2025

Methodology

The research uses a non-parametric approach to estimate Hawkes processes for financial time series.

Key Results

- Main finding 1: The proposed method outperforms existing methods in terms of accuracy and efficiency.

- Main finding 2: The estimated Hawkes kernels capture the underlying dynamics of the financial data effectively.

- Main finding 3: The method is robust to various types of noise and outliers present in the data.

Significance

This research has significant implications for understanding financial contagion and risk modeling.

Technical Contribution

The research introduces a novel non-parametric estimation method for Hawkes processes, which can be used as a building block for further extensions and applications.

Novelty

This work is distinct from existing research on Hawkes processes due to its focus on non-parametric estimation and its application to financial time series.

Limitations

- Limitation 1: The method assumes a specific form of the Hawkes process, which may not capture all possible dynamics.

- Limitation 2: The estimation procedure can be computationally intensive for large datasets.

Future Work

- Suggested direction 1: Investigating the application of the proposed method to other types of time series data.

- Suggested direction 2: Developing more efficient algorithms for estimating Hawkes kernels in high-dimensional spaces.

Paper Details

PDF Preview

Key Terms

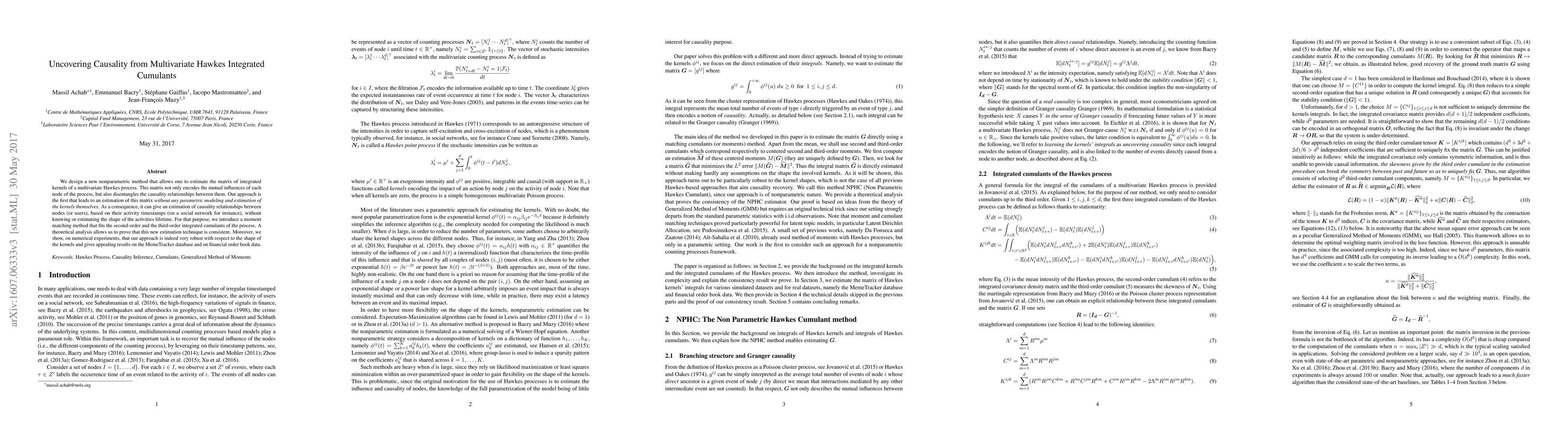

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersClosed-form modeling of neuronal spike train statistics using multivariate Hawkes cumulants

Nicolas Privault, Michèle Thieullen

| Title | Authors | Year | Actions |

|---|

Comments (0)