Summary

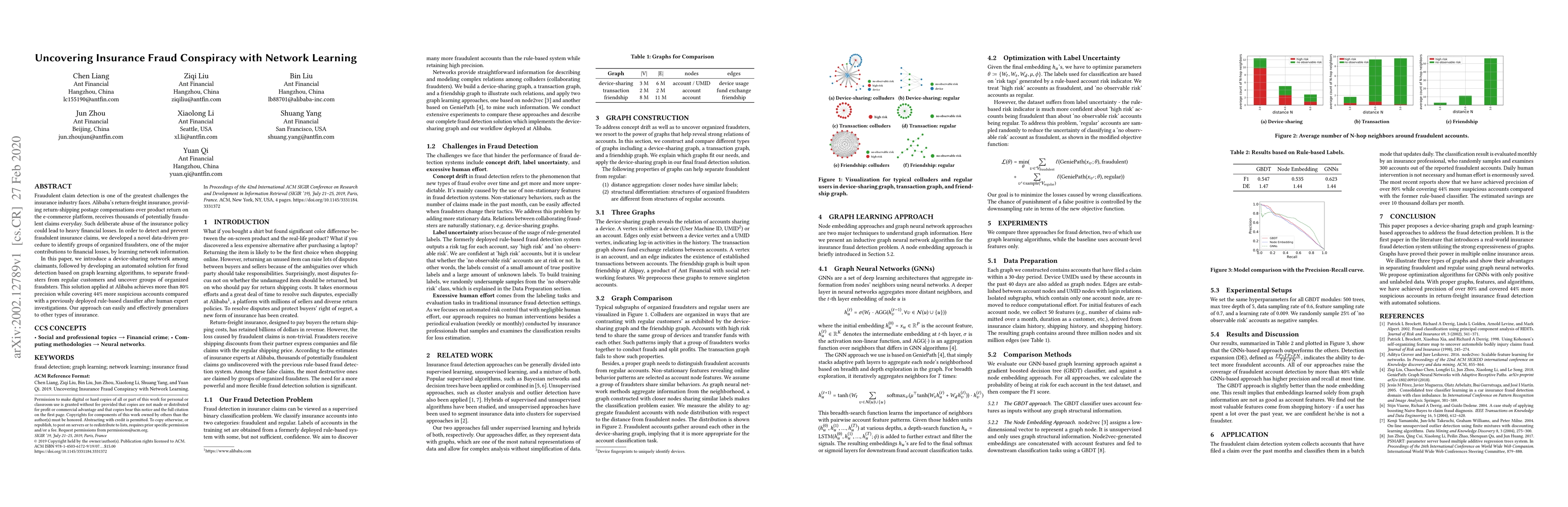

Fraudulent claim detection is one of the greatest challenges the insurance industry faces. Alibaba's return-freight insurance, providing return-shipping postage compensations over product return on the e-commerce platform, receives thousands of potentially fraudulent claims every day. Such deliberate abuse of the insurance policy could lead to heavy financial losses. In order to detect and prevent fraudulent insurance claims, we developed a novel data-driven procedure to identify groups of organized fraudsters, one of the major contributions to financial losses, by learning network information. In this paper, we introduce a device-sharing network among claimants, followed by developing an automated solution for fraud detection based on graph learning algorithms, to separate fraudsters from regular customers and uncover groups of organized fraudsters. This solution applied at Alibaba achieves more than 80% precision while covering 44% more suspicious accounts compared with a previously deployed rule-based classifier after human expert investigations. Our approach can easily and effectively generalizes to other types of insurance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn engine to simulate insurance fraud network data

Bavo D. C. Campo, Katrien Antonio

Insurance claims estimation and fraud detection with optimized deep learning techniques.

Anand Kumar, P, Sountharrajan, S

An Attack Method for Medical Insurance Claim Fraud Detection based on Generative Adversarial Network

Chenghan Li, Yining Pang

| Title | Authors | Year | Actions |

|---|

Comments (0)