Summary

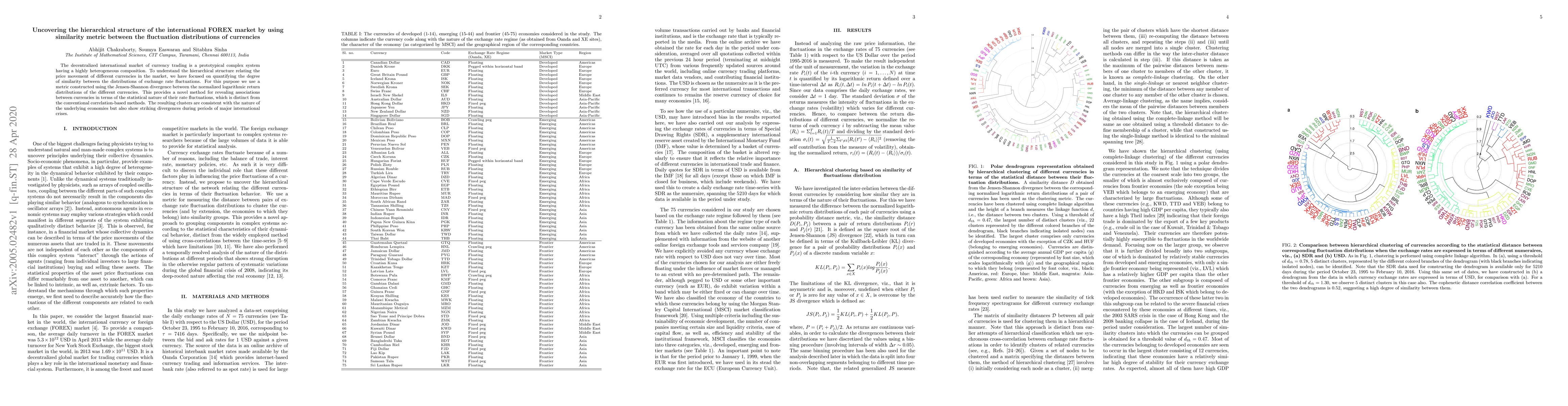

The decentralized international market of currency trading is a prototypical complex system having a highly heterogeneous composition. To understand the hierarchical structure relating the price movement of different currencies in the market, we have focused on quantifying the degree of similarity between the distributions of exchange rate fluctuations. For this purpose we use a metric constructed using the Jensen-Shannon divergence between the normalized logarithmic return distributions of the different currencies. This provides a novel method for revealing associations between currencies in terms of the statistical nature of their rate fluctuations, which is distinct from the conventional correlation-based methods. The resulting clusters are consistent with the nature of the underlying economies but also show striking divergences during periods of major international crises.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)