Summary

Economic crimes such as money laundering, terrorism financing, tax evasion or corruption almost invariably involve the use of a corporate entity. Such entities are regularly incorporated and managed by corporate services providers (CSPs). Given this potential for enabling economic crime, the CSP industry in the Netherlands is heavily regulated and CSPs require a license to operate. Operating without a licence is illegal. In this paper, we estimate the size of the illegal CSP sector in the Netherlands. For this, we develop a classification method to detect potentially illegal CSPs based on their similarity with licensed CSPs. Similarity is computed based on their position within the network of directors, companies and addresses, and the characteristics of such entities. We manually annotate a sample of the potential illegal CSPs and estimate that illegal CSPs constitute 31--51\% of the total number of CSPs and manage 19--27\% of all companies managed by CSPs. Our analysis provides a tool to regulators to improve detection and prevention of economic crime, and can be extended to the estimation of other illegal activities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

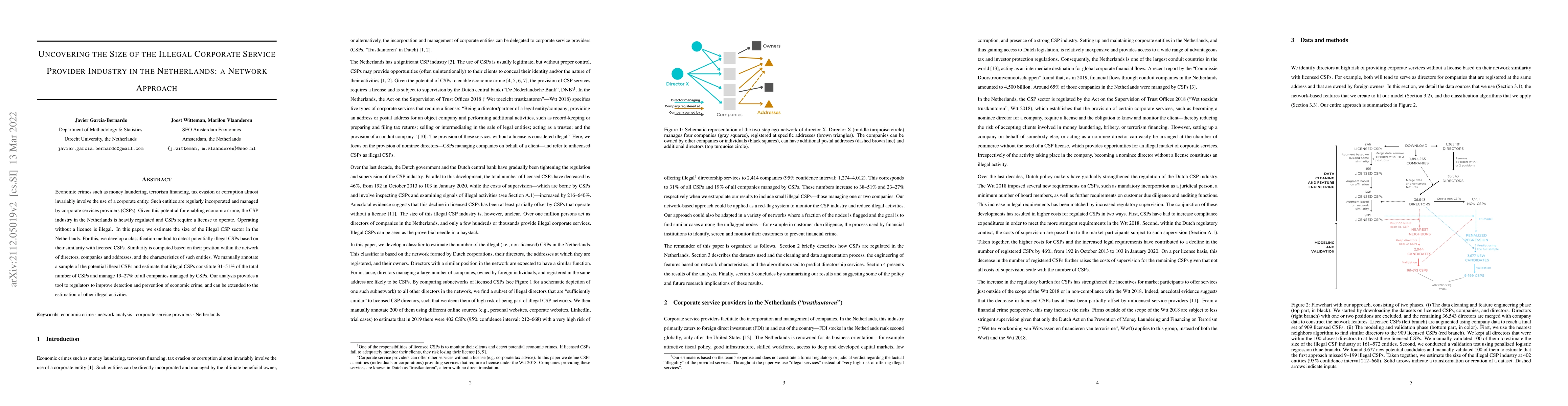

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUncovering Offshore Financial Centers: Conduits and Sinks in the Global Corporate Ownership Network

Frank W. Takes, Eelke M. Heemskerk, Javier Garcia-Bernardo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)