Summary

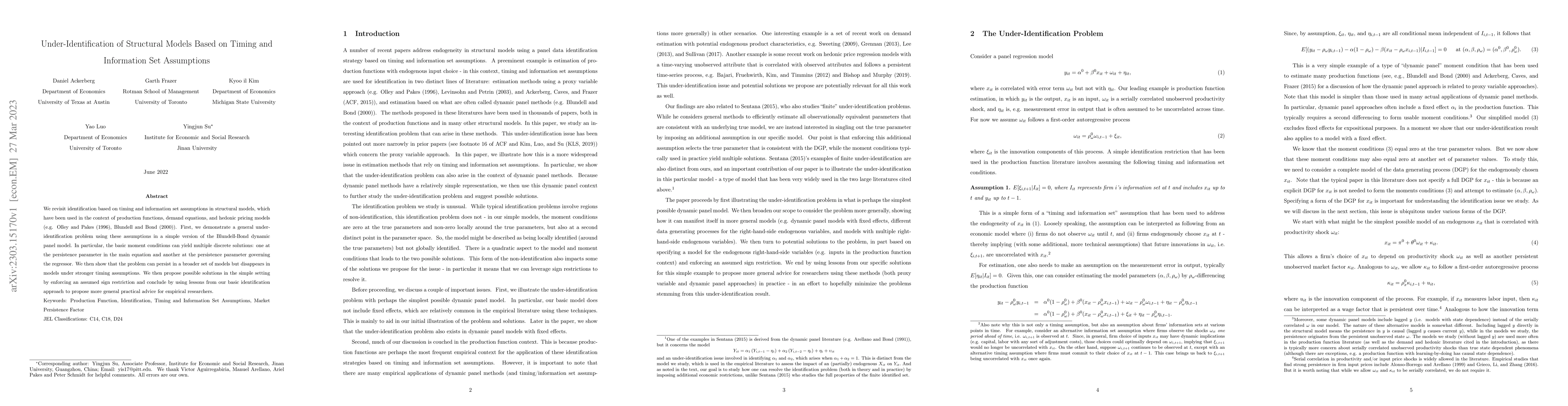

We revisit identification based on timing and information set assumptions in structural models, which have been used in the context of production functions, demand equations, and hedonic pricing models (e.g. Olley and Pakes (1996), Blundell and Bond (2000)). First, we demonstrate a general under-identification problem using these assumptions in a simple version of the Blundell-Bond dynamic panel model. In particular, the basic moment conditions can yield multiple discrete solutions: one at the persistence parameter in the main equation and another at the persistence parameter governing the regressor. We then show that the problem can persist in a broader set of models but disappears in models under stronger timing assumptions. We then propose possible solutions in the simple setting by enforcing an assumed sign restriction and conclude by using lessons from our basic identification approach to propose more general practical advice for empirical researchers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStructural Nested Mean Models Under Parallel Trends Assumptions

Eric Tchetgen Tchetgen, Oliver Dukes, Zach Shahn et al.

Information capacity of quantum communication under natural physical assumptions

Jef Pauwels, Stefano Pironio, Armin Tavakoli

| Title | Authors | Year | Actions |

|---|

Comments (0)