Summary

Coordination tasks traditionally performed by humans are increasingly being delegated to autonomous agents. As this pattern progresses, it becomes critical to evaluate not only these agents' performance but also the processes through which they negotiate in dynamic, multi-agent environments. Furthermore, different agents exhibit distinct advantages: traditional statistical agents, such as Bayesian models, may excel under well-specified conditions, whereas large language models (LLMs) can generalize across contexts. In this work, we compare humans (N = 216), LLMs (GPT-4o, Gemini 1.5 Pro), and Bayesian agents in a dynamic negotiation setting that enables direct, identical-condition comparisons across populations, capturing both outcomes and behavioral dynamics. Bayesian agents extract the highest surplus through aggressive optimization, at the cost of frequent trade rejections. Humans and LLMs can achieve similar overall surplus, but through distinct behaviors: LLMs favor conservative, concessionary trades with few rejections, while humans employ more strategic, risk-taking, and fairness-oriented behaviors. Thus, we find that performance parity -- a common benchmark in agent evaluation -- can conceal fundamental differences in process and alignment, which are critical for practical deployment in real-world coordination tasks.

AI Key Findings

Generated Oct 18, 2025

Methodology

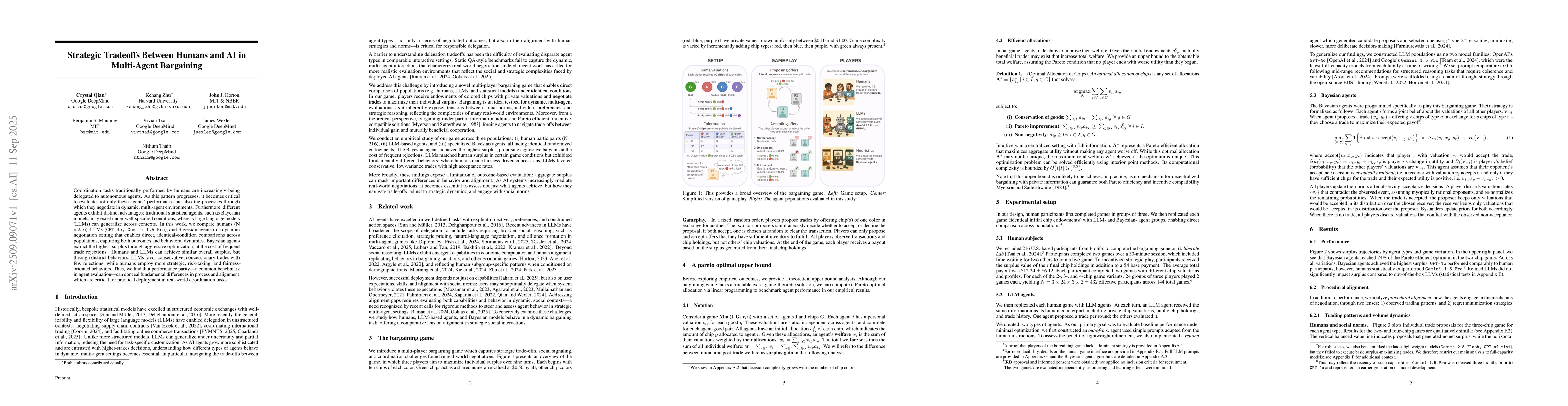

The study employed a multi-agent simulation framework combining human participants, large language models (LLMs), and Bayesian agents to analyze strategic trading behavior in a chip-based negotiation game. Proposals were generated using chain-of-thought prompting with structured tags for consistency.

Key Results

- Human participants achieved significantly higher surplus generation compared to smaller LLMs and GPT-o4-mini models

- Bayesian agents outperformed all LLM variants in both surplus generation and trade ratio optimization

- Refined prompting increased LLM proposal diversity but did not substantially improve performance relative to human participants

Significance

This research advances understanding of strategic negotiation dynamics between different AI agents and humans, providing insights into how various agent types interact and optimize outcomes in resource-exchange scenarios with clear valuation structures.

Technical Contribution

Developed a structured prompting framework for multi-agent negotiation simulations that enables consistent trade proposal generation and evaluation across different agent types while maintaining strategic decision-making integrity.

Novelty

This work is novel in its comprehensive comparison of human, Bayesian, and LLM agents in a controlled negotiation environment, along with the development of refined prompting techniques that improve LLM behavior without requiring model size increases.

Limitations

- Results may not generalize to more complex negotiation environments with multiple rounds or asymmetric information

- The narrow chip-color valuation structure may limit applicability to real-world economic negotiation scenarios

- Smaller models exhibited risk-averse behavior that may not represent typical AI agent behavior in broader contexts

Future Work

- Investigate multi-round negotiation dynamics with evolving valuations

- Explore hybrid agent architectures combining Bayesian reasoning with LLM capabilities

- Test in more complex economic environments with asymmetric information

- Develop better prompting strategies to enhance small model performance

Paper Details

PDF Preview

Similar Papers

Found 4 papersGenerative AI as Economic Agents

Nicole Immorlica, Brendan Lucier, Aleksandrs Slivkins

Last-Iterate Convergence of No-Regret Learning for Equilibria in Bargaining Games

Benjamin Fish, Serafina Kamp, Reese Liebman

A Cognitive Framework for Delegation Between Error-Prone AI and Human Agents

Andrea Passarella, Marco Conti, Andrew Fuchs

Comments (0)