Summary

The purpose of this paper is to advance the understanding of the conditions that give rise to flash crash contagion, particularly with respect to overlapping asset portfolio crowding. To this end, we designed, implemented, and assessed a hybrid micro-macro agent-based model, where price impact arises endogenously through the limit order placement activity of algorithmic traders. Our novel hybrid microscopic and macroscopic model allows us to quantify systemic risk not just in terms of system stability, but also in terms of the speed of financial distress propagation over intraday timescales. We find that systemic risk is strongly dependent on the behaviour of algorithmic traders, on leverage management practices, and on network topology. Our results demonstrate that, for high-crowding regimes, contagion speed is a non-monotone function of portfolio diversification. We also find the surprising result that, in certain circumstances, increased portfolio crowding is beneficial to systemic stability. We are not aware of previous studies that have exhibited this phenomenon, and our results establish the importance of considering non-uniform asset allocations in future studies. Finally, we characterise the time window available for regulatory interventions during the propagation of flash crash distress, with results suggesting ex ante precautions may have higher efficacy than ex post reactions.

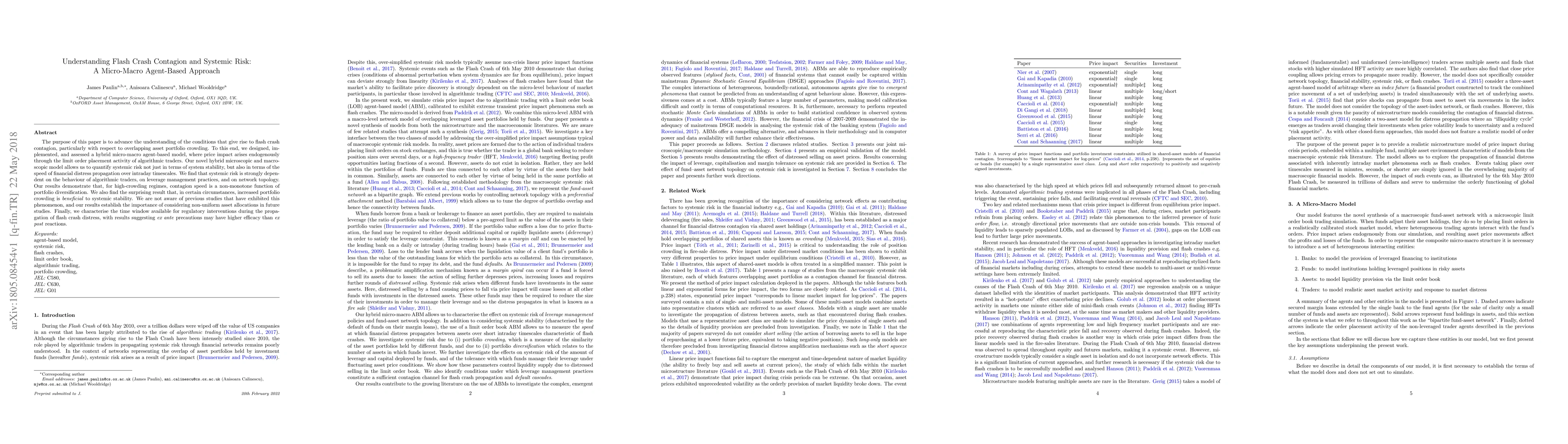

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHigh-frequency financial market simulation and flash crash scenarios analysis: an agent-based modelling approach

Wayne Luk, Kang Gao, Perukrishnen Vytelingum et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)