Authors

Summary

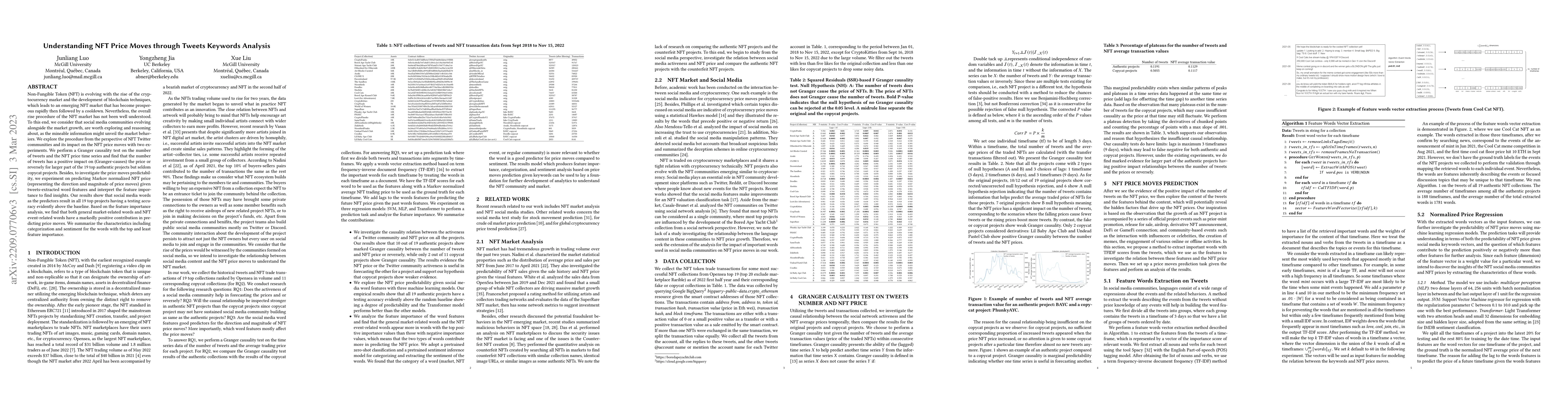

Non-Fungible Token (NFT) is evolving with the rise of the cryptocurrency market and the development of blockchain techniques, which leads to an emerging NFT market that has become prosperous rapidly then followed by a cooldown. Nevertheless, the overall rise procedure of the NFT market has not been well understood. To this end, we consider that social media communities evolving alongside the market growth, are worth exploring and reasoning about, as the mineable information might unveil the market behaviors. We explore the procedure from the perspective of NFT Twitter communities and its impact on the NFT price moves with two experiments. We perform a Granger causality test on the number of tweets and the NFT price time series and find that the number of tweets has a positive impact on (Granger-causes) the price or reversely for larger part of the 19 top authentic projects but seldom copycat projects. Besides, to investigate the price moves predictability, we experiment on predicting Markov normalized NFT price (representing the direction and magnitude of price moves) given tweets-extracted word features and interpret the feature importance to find insights. Our results show that social media words as the predictors result in all 19 top projects having a testing accuracy evidently above the baseline. Based on the feature importance analysis, we find that both general market-related words and NFT event-related words have a markedly positive contribution in predicting price moves. We summarize the characteristics including categorization and sentiment for the words with the top and least feature importance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCOMET: NFT Price Prediction with Wallet Profiling

Qi Zhang, Hui Xiong, Chao Wang et al.

Constructing a NFT Price Index and Applications

Hugo Inzirillo, Hugo Schnoering

Understanding Rug Pulls: An In-Depth Behavioral Analysis of Fraudulent NFT Creators

Sandeep Kumar Shukla, Rachit Agarwal, Trishie Sharma

| Title | Authors | Year | Actions |

|---|

Comments (0)