Summary

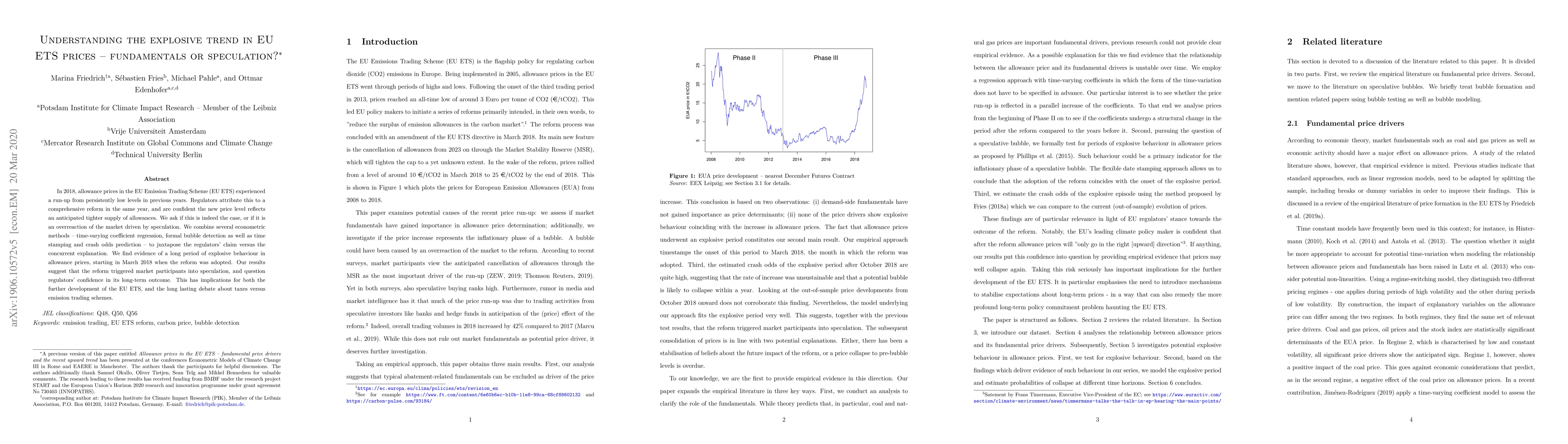

In 2018, allowance prices in the EU Emission Trading Scheme (EU ETS) experienced a run-up from persistently low levels in previous years. Regulators attribute this to a comprehensive reform in the same year, and are confident the new price level reflects an anticipated tighter supply of allowances. We ask if this is indeed the case, or if it is an overreaction of the market driven by speculation. We combine several econometric methods - time-varying coefficient regression, formal bubble detection as well as time stamping and crash odds prediction - to juxtapose the regulators' claim versus the concurrent explanation. We find evidence of a long period of explosive behaviour in allowance prices, starting in March 2018 when the reform was adopted. Our results suggest that the reform triggered market participants into speculation, and question regulators' confidence in its long-term outcome. This has implications for both the further development of the EU ETS, and the long lasting debate about taxes versus emission trading schemes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReview of the EU ETS Literature: A Bibliometric Perspective

Cristiano Salvagnin

Regional emission dynamics across phases of the EU ETS

Antoine Mandel, Marco Dueñas

| Title | Authors | Year | Actions |

|---|

Comments (0)