Summary

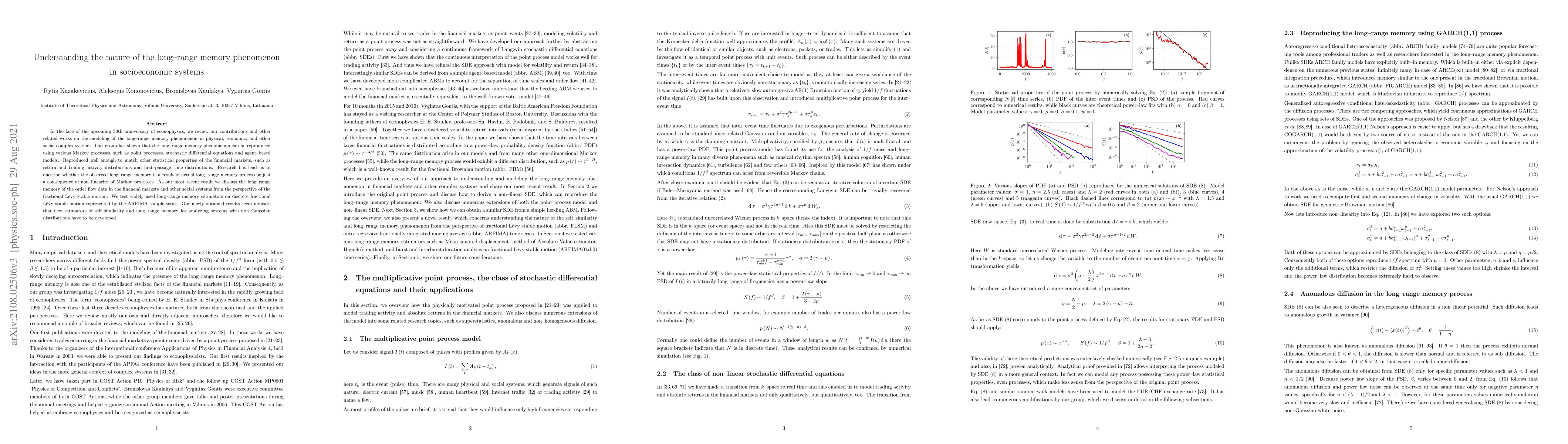

In the face of the upcoming 30th anniversary of econophysics, we review our contributions and other related works on the modeling of the long-range memory phenomenon in physical, economic, and other social complex systems. Our group has shown that the long-range memory phenomenon can be reproduced using various Markov processes, such as point processes, stochastic differential equations and agent-based models. Reproduced well enough to match other statistical properties of the financial markets, such as return and trading activity distributions and first-passage time distributions. Research has lead us to question whether the observed long-range memory is a result of actual long-range memory process or just a consequence of non-linearity of Markov processes. As our most recent result we discuss the long-range memory of the order flow data in the financial markets and other social systems from the perspective of the fractional L\`{e}vy stable motion. We test widely used long-range memory estimators on discrete fractional L\`{e}vy stable motion represented by the ARFIMA sample series. Our newly obtained results seem indicate that new estimators of self-similarity and long-range memory for analyzing systems with non-Gaussian distributions have to be developed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)