Summary

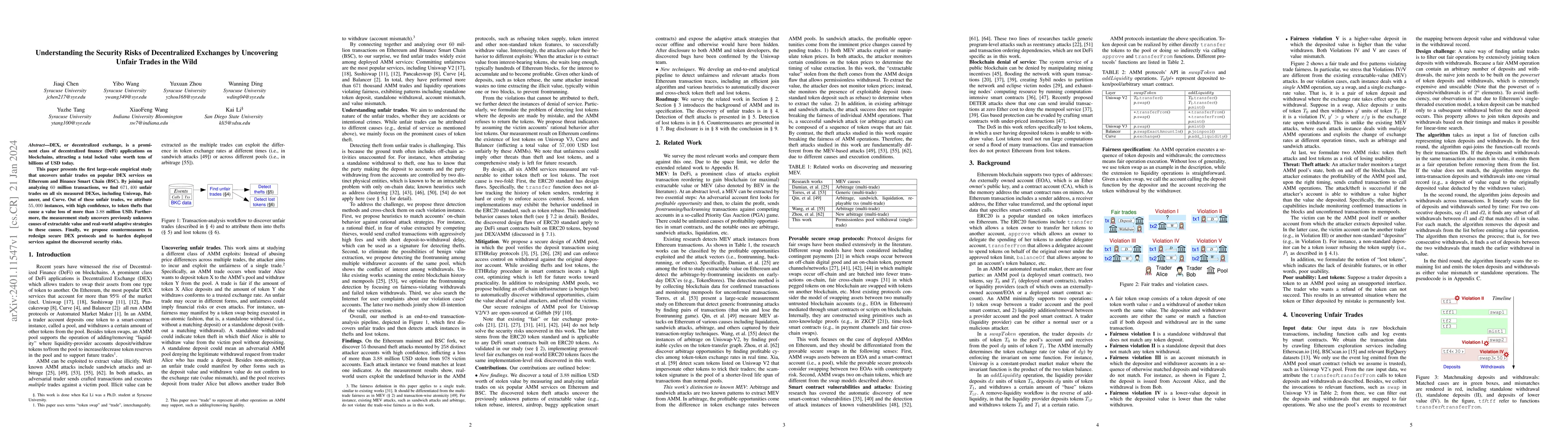

DEX, or decentralized exchange, is a prominent class of decentralized finance (DeFi) applications on blockchains, attracting a total locked value worth tens of billions of USD today. This paper presents the first large-scale empirical study that uncovers unfair trades on popular DEX services on Ethereum and Binance Smart Chain (BSC). By joining and analyzing 60 million transactions, we find 671,400 unfair trades on all six measured DEXes, including Uniswap, Balancer, and Curve. Out of these unfair trades, we attribute 55,000 instances, with high confidence, to token thefts that cause a value loss of more than 3.88 million USD. Furthermore, the measurement study uncovers previously unknown causes of extractable value and real-world adaptive strategies to these causes. Finally, we propose countermeasures to redesign secure DEX protocols and to harden deployed services against the discovered security risks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersToward Understanding the Use of Centralized Exchanges for Decentralized Cryptocurrency

Bohui Shen, Zhixuan Zhou

Moneros Decentralized P2P Exchanges: Functionality, Adoption, and Privacy Risks

Stefan Schmid, Yannik Kopyciok, Friedhelm Victor

| Title | Authors | Year | Actions |

|---|

Comments (0)