Authors

Summary

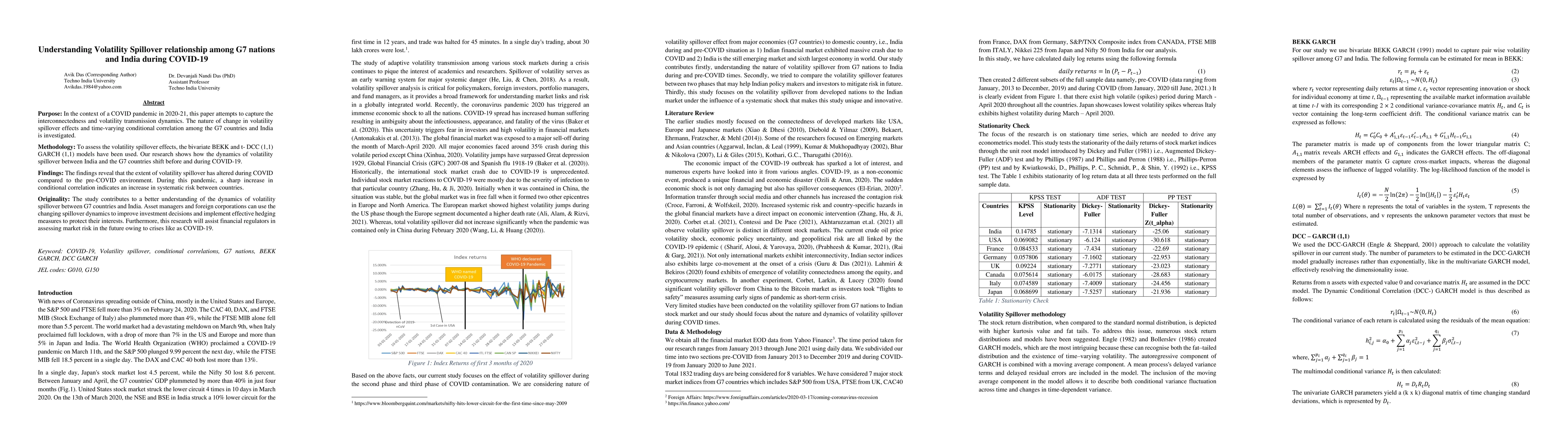

Purpose: In the context of a COVID pandemic in 2020-21, this paper attempts to capture the interconnectedness and volatility transmission dynamics. The nature of change in volatility spillover effects and time-varying conditional correlation among the G7 countries and India is investigated. Methodology: To assess the volatility spillover effects, the bivariate BEKK and t- DCC (1,1) GARCH (1,1) models have been used. Our research shows how the dynamics of volatility spillover between India and the G7 countries shift before and during COVID-19. Findings: The findings reveal that the extent of volatility spillover has altered during COVID compared to the pre-COVID environment. During this pandemic, a sharp increase in conditional correlation indicates an increase in systematic risk between countries. Originality: The study contributes to a better understanding of the dynamics of volatility spillover between G7 countries and India. Asset managers and foreign corporations can use the changing spillover dynamics to improve investment decisions and implement effective hedging measures to protect their interests. Furthermore, this research will assist financial regulators in assessing market risk in the future owing to crises like as COVID-19.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIncivility and Contentiousness Spillover between COVID-19 and Climate Science Engagement

Ted Hsuan Yun Chen, Arash Badie-Modiri, Hasti Narimanzadeh et al.

No citations found for this paper.

Comments (0)