Authors

Summary

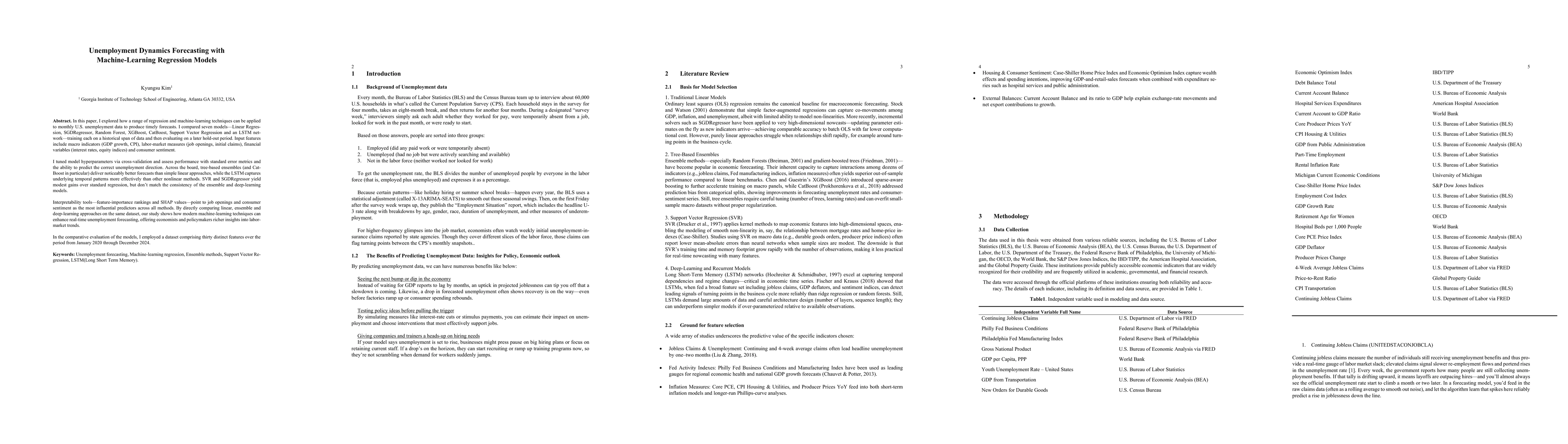

In this paper, I explored how a range of regression and machine learning techniques can be applied to monthly U.S. unemployment data to produce timely forecasts. I compared seven models: Linear Regression, SGDRegressor, Random Forest, XGBoost, CatBoost, Support Vector Regression, and an LSTM network, training each on a historical span of data and then evaluating on a later hold-out period. Input features include macro indicators (GDP growth, CPI), labor market measures (job openings, initial claims), financial variables (interest rates, equity indices), and consumer sentiment. I tuned model hyperparameters via cross-validation and assessed performance with standard error metrics and the ability to predict the correct unemployment direction. Across the board, tree-based ensembles (and CatBoost in particular) deliver noticeably better forecasts than simple linear approaches, while the LSTM captures underlying temporal patterns more effectively than other nonlinear methods. SVR and SGDRegressor yield modest gains over standard regression but don't match the consistency of the ensemble and deep-learning models. Interpretability tools ,feature importance rankings and SHAP values, point to job openings and consumer sentiment as the most influential predictors across all methods. By directly comparing linear, ensemble, and deep-learning approaches on the same dataset, our study shows how modern machine-learning techniques can enhance real-time unemployment forecasting, offering economists and policymakers richer insights into labor market trends. In the comparative evaluation of the models, I employed a dataset comprising thirty distinct features over the period from January 2020 through December 2024.

AI Key Findings

Generated May 28, 2025

Methodology

The paper employs a comparative analysis of seven machine learning regression models (Linear Regression, SGDRegressor, Random Forest, XGBoost, CatBoost, Support Vector Regression, and LSTM) to forecast U.S. unemployment using 30 macroeconomic indicators from January 2020 to December 2024. Hyperparameters are tuned via cross-validation, and model performance is assessed using standard error metrics and direction prediction accuracy.

Key Results

- Tree-based ensemble models (especially CatBoost) outperform linear approaches and SVR, providing better unemployment forecasts.

- LSTM captures temporal patterns effectively, though it doesn't surpass ensemble and deep-learning models in this context.

- Job openings and consumer sentiment are identified as the most influential predictors across all methods.

Significance

This study demonstrates the enhanced capabilities of modern machine learning techniques in real-time unemployment forecasting, offering economists and policymakers more nuanced insights into labor market trends.

Technical Contribution

The paper presents a comprehensive comparison of linear, ensemble, and deep-learning approaches for unemployment forecasting, highlighting the superiority of tree-based ensembles and LSTMs in capturing complex patterns.

Novelty

By directly comparing various machine learning techniques on the same dataset, this research offers a novel perspective on the effectiveness of different models in predicting unemployment dynamics.

Limitations

- The study's findings may not generalize to other countries or economic contexts due to its focus on U.S. data.

- Relatively small sample size (30 features over 4 years) might limit the robustness of conclusions.

Future Work

- Investigate the applicability of these models to other countries' unemployment forecasting.

- Explore the impact of larger and more diverse datasets on model performance and generalizability.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)