Summary

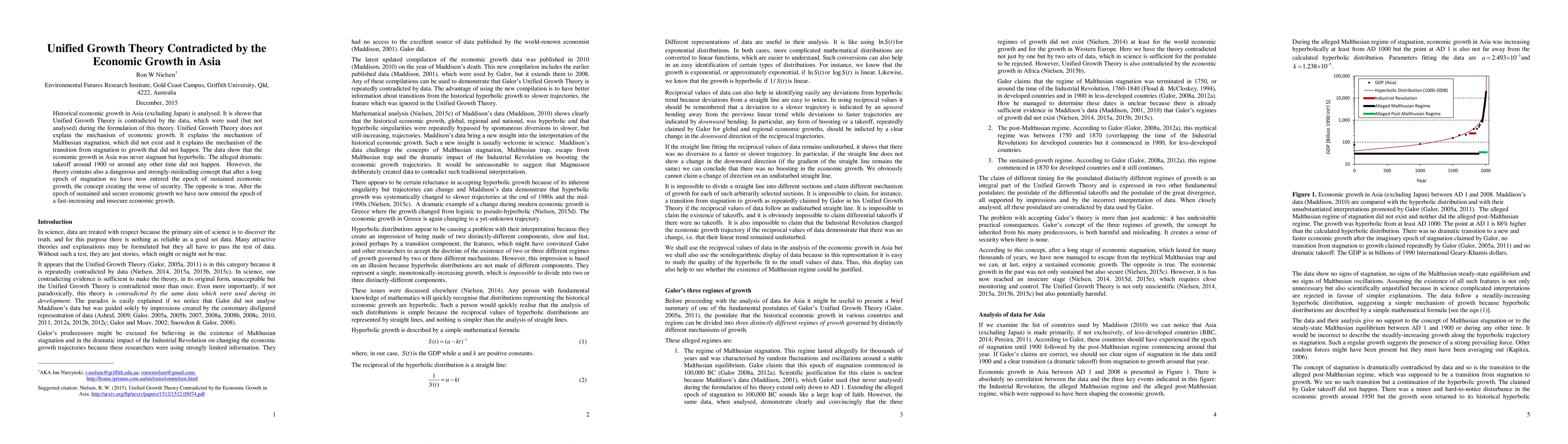

Historical economic growth in Asia (excluding Japan) is analysed. It is shown that Unified Growth Theory is contradicted by the data, which were used (but not analysed) during the formulation of this theory. Unified Growth Theory does not explain the mechanism of economic growth. It explains the mechanism of Malthusian stagnation, which did not exist and it explains the mechanism of the transition from stagnation to growth that did not happen. The data show that the economic growth in Asia was never stagnant but hyperbolic. The alleged dramatic takeoff around 1900 or around any other time did not happen. However, the theory contains also a dangerous and strongly-misleading concept that after a long epoch of stagnation we have now entered the epoch of sustained economic growth, the concept creating the sense of security. The opposite is true. After the epoch of sustained and secure economic growth we have now entered the epoch of a fast-increasing and insecure economic growth.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)