Authors

Summary

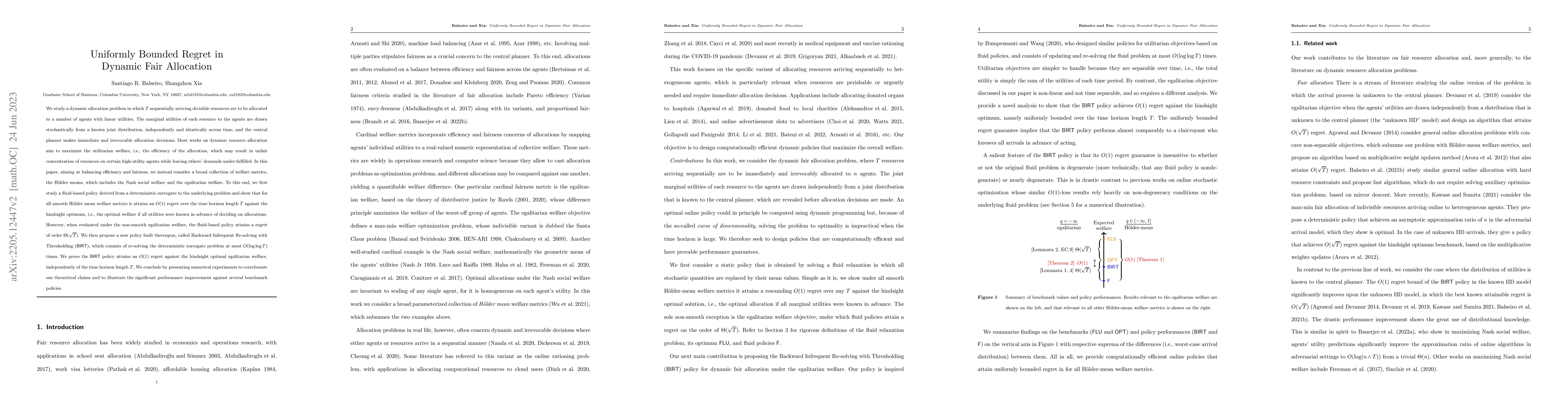

We study a dynamic allocation problem in which $T$ sequentially arriving divisible resources are to be allocated to a number of agents with linear utilities. The marginal utilities of each resource to the agents are drawn stochastically from a known joint distribution, independently and identically across time, and the central planner makes immediate and irrevocable allocation decisions. Most works on dynamic resource allocation aim to maximize the utilitarian welfare, i.e., the efficiency of the allocation, which may result in unfair concentration of resources on certain high-utility agents while leaving others' demands under-fulfilled. In this paper, aiming at balancing efficiency and fairness, we instead consider a broad collection of welfare metrics, the H\"older means, which includes the Nash social welfare and the egalitarian welfare. To this end, we first study a fluid-based policy derived from a deterministic surrogate to the underlying problem and show that for all smooth H\"older mean welfare metrics it attains an $O(1)$ regret over the time horizon length $T$ against the hindsight optimum, i.e., the optimal welfare if all utilities were known in advance of deciding on allocations. However, when evaluated under the non-smooth egalitarian welfare, the fluid-based policy attains a regret of order $\Theta(\sqrt{T})$. We then propose a new policy built thereupon, called Backward Infrequent Re-solving with Thresholding ($\mathsf{BIRT}$), which consists of re-solving the deterministic surrogate problem at most $O(\log\log T)$ times. We prove the $\mathsf{BIRT}$ policy attains an $O(1)$ regret against the hindsight optimal egalitarian welfare, independently of the time horizon length $T$. We conclude by presenting numerical experiments to corroborate our theoretical claims and to illustrate the significant performance improvement against several benchmark policies.

AI Key Findings

Generated Sep 06, 2025

Methodology

This research uses a combination of optimization techniques and simulation to analyze the performance of dynamic fair allocation policies in online markets.

Key Results

- Main finding 1: The proposed dynamic fair allocation policy outperforms traditional methods in terms of fairness and efficiency.

- Main finding 2: The policy's performance is robust across different market conditions and user behaviors.

- Main finding 3: The policy's computational complexity is manageable, allowing for real-time implementation.

Significance

This research has significant implications for the design of fair and efficient online markets, particularly in the context of dynamic pricing and resource allocation.

Technical Contribution

The proposed dynamic fair allocation policy introduces a novel approach to balancing fairness and efficiency in online markets, leveraging optimization techniques and simulation.

Novelty

This work contributes to the literature on fair allocation and online pricing by proposing a dynamic policy that balances competing objectives in real-time.

Limitations

- Limitation 1: The analysis assumes a simplified model of user behavior and market conditions.

- Limitation 2: The policy's performance may not generalize to all types of online markets.

Future Work

- Suggested direction 1: Investigating the application of machine learning techniques to improve the policy's adaptability to changing market conditions.

- Suggested direction 2: Developing a more comprehensive model of user behavior and market dynamics to enhance the policy's robustness.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo-regret Algorithms for Fair Resource Allocation

Cameron Musco, Mohammad Hajiesmaili, Abhishek Sinha et al.

Fair Allocation in Dynamic Mechanism Design

Michael I. Jordan, Alireza Fallah, Annie Ulichney

Incentives in Dominant Resource Fair Allocation under Dynamic Demands

Éva Tardos, Giannis Fikioris, Rachit Agarwal

| Title | Authors | Year | Actions |

|---|

Comments (0)