Summary

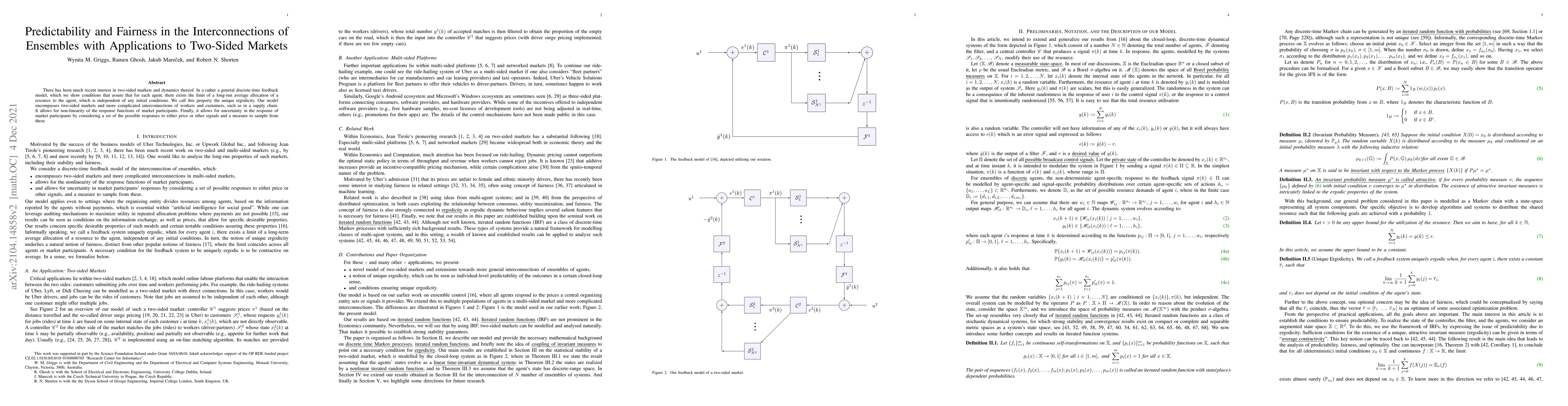

There has been much recent interest in two-sided markets and dynamics thereof. In a rather a general discrete-time feedback model, which we show conditions that assure that for each agent, there exists the limit of a long-run average allocation of a resource to the agent, which is independent of any initial conditions. We call this property the unique ergodicity. Our model encompasses two-sided markets and more complicated interconnections of workers and customers, such as in a supply chain. It allows for non-linearity of the response functions of market participants. Finally, it allows for uncertainty in the response of market participants by considering a set of the possible responses to either price or other signals and a measure to sample from these.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersThe Power of Two-sided Recruitment in Two-sided Markets

Aranyak Mehta, Christopher Liaw, Yang Cai et al.

Subgroup Fairness in Two-Sided Markets

Quan Zhou, Robert N. Shorten, Jakub Marecek

Efficient Two-Sided Markets with Limited Information

Paul Dütting, Federico Fusco, Stefano Leonardi et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)