Authors

Summary

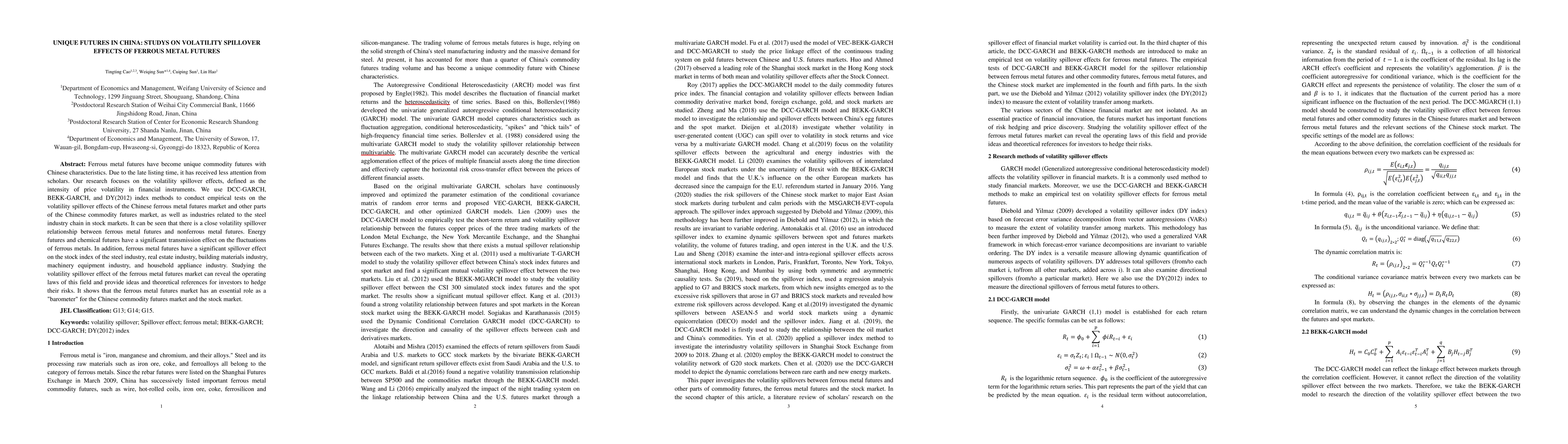

Ferrous metal futures have become unique commodity futures with Chinese characteristics. Due to the late listing time, it has received less attention from scholars. Our research focuses on the volatility spillover effects, defined as the intensity of price volatility in financial instruments. We use DCC-GARCH, BEKK-GARCH, and DY(2012) index methods to conduct empirical tests on the volatility spillover effects of the Chinese ferrous metal futures market and other parts of the Chinese commodity futures market, as well as industries related to the steel industry chain in stock markets. It can be seen that there is a close volatility spillover relationship between ferrous metal futures and nonferrous metal futures. Energy futures and chemical futures have a significant transmission effect on the fluctuations of ferrous metals. In addition, ferrous metal futures have a significant spillover effect on the stock index of the steel industry, real estate industry, building materials industry, machinery equipment industry, and household appliance industry. Studying the volatility spillover effect of the ferrous metal futures market can reveal the operating laws of this field and provide ideas and theoretical references for investors to hedge their risks. It shows that the ferrous metal futures market has an essential role as a "barometer" for the Chinese commodity futures market and the stock market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)