Summary

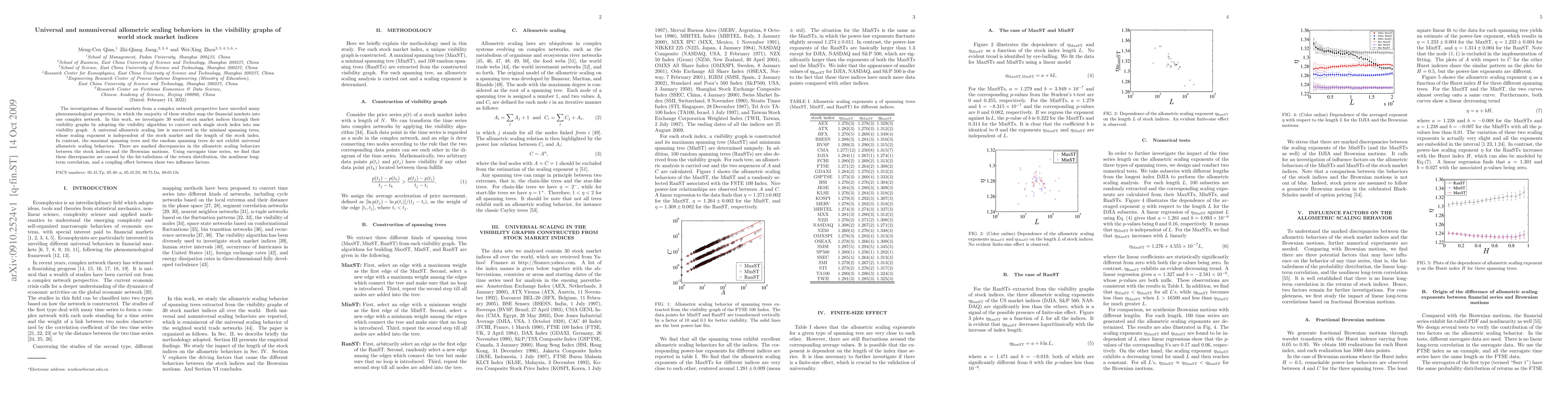

The investigations of financial markets from a complex network perspective have unveiled many phenomenological properties, in which the majority of these studies map the financial markets into one complex network. In this work, we investigate 30 world stock market indices through their visibility graphs by adopting the visibility algorithm to convert each single stock index into one visibility graph. A universal allometric scaling law is uncovered in the minimal spanning trees, whose scaling exponent is independent of the stock market and the length of the stock index. In contrast, the maximal spanning trees and the random spanning trees do not exhibit universal allometric scaling behaviors. There are marked discrepancies in the allometric scaling behaviors between the stock indices and the Brownian motions. Using surrogate time series, we find that these discrepancies are caused by the fat-tailedness of the return distribution, the nonlinear long-term correlation, and a coupling effect between these two influence factors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)