Summary

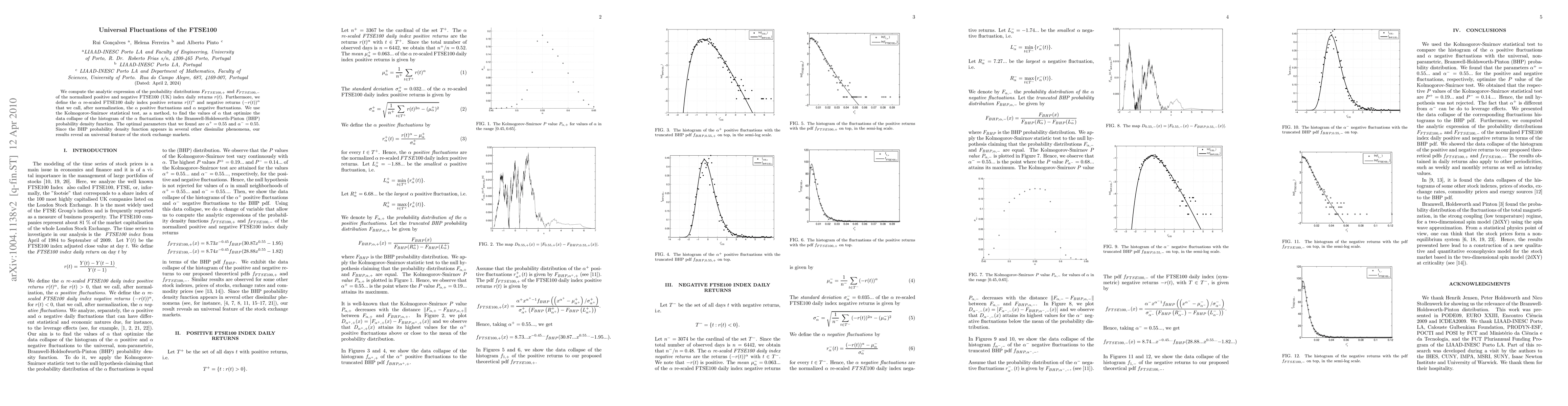

We compute the analytic expression of the probability distributions F{FTSE100,+} and F{FTSE100,-} of the normalized positive and negative FTSE100 (UK) index daily returns r(t). Furthermore, we define the alpha re-scaled FTSE100 daily index positive returns r(t)^alpha and negative returns (-r(t))^alpha that we call, after normalization, the alpha positive fluctuations and alpha negative fluctuations. We use the Kolmogorov-Smirnov statistical test, as a method, to find the values of alpha that optimize the data collapse of the histogram of the alpha fluctuations with the Bramwell-Holdsworth-Pinton (BHP) probability density function. The optimal parameters that we found are alpha+=0.55 and alpha-=0.55. Since the BHP probability density function appears in several other dissimilar phenomena, our results reveal universality in the stock exchange markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCornering the universal shape of fluctuations

William Witczak-Krempa, Benoit Estienne, Jean-Marie Stéphan

No citations found for this paper.

Comments (0)