Summary

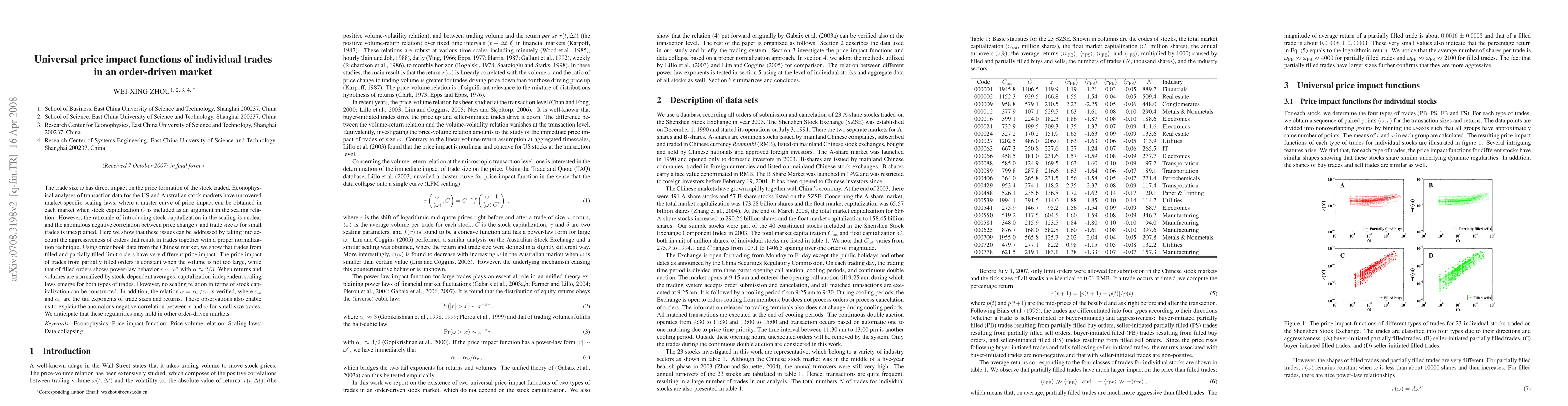

The trade size $\omega$ has direct impact on the price formation of the stock traded. Econophysical analyses of transaction data for the US and Australian stock markets have uncovered market-specific scaling laws, where a master curve of price impact can be obtained in each market when stock capitalization $C$ is included as an argument in the scaling relation. However, the rationale of introducing stock capitalization in the scaling is unclear and the anomalous negative correlation between price change $r$ and trade size $\omega$ for small trades is unexplained. Here we show that these issues can be addressed by taking into account the aggressiveness of orders that result in trades together with a proper normalization technique. Using order book data from the Chinese market, we show that trades from filled and partially filled limit orders have very different price impact. The price impact of trades from partially filled orders is constant when the volume is not too large, while that of filled orders shows power-law behavior $r\sim \omega^\alpha$ with $\alpha\approx2/3$. When returns and volumes are normalized by stock-dependent averages, capitalization-independent scaling laws emerge for both types of trades. However, no scaling relation in terms of stock capitalization can be constructed. In addition, the relation $\alpha=\alpha_\omega/\alpha_r$ is verified, where $\alpha_\omega$ and $\alpha_r$ are the tail exponents of trade sizes and returns. These observations also enable us to explain the anomalous negative correlation between $r$ and $\omega$ for small-size trades. We anticipate that these regularities may hold in other order-driven markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)