Authors

Summary

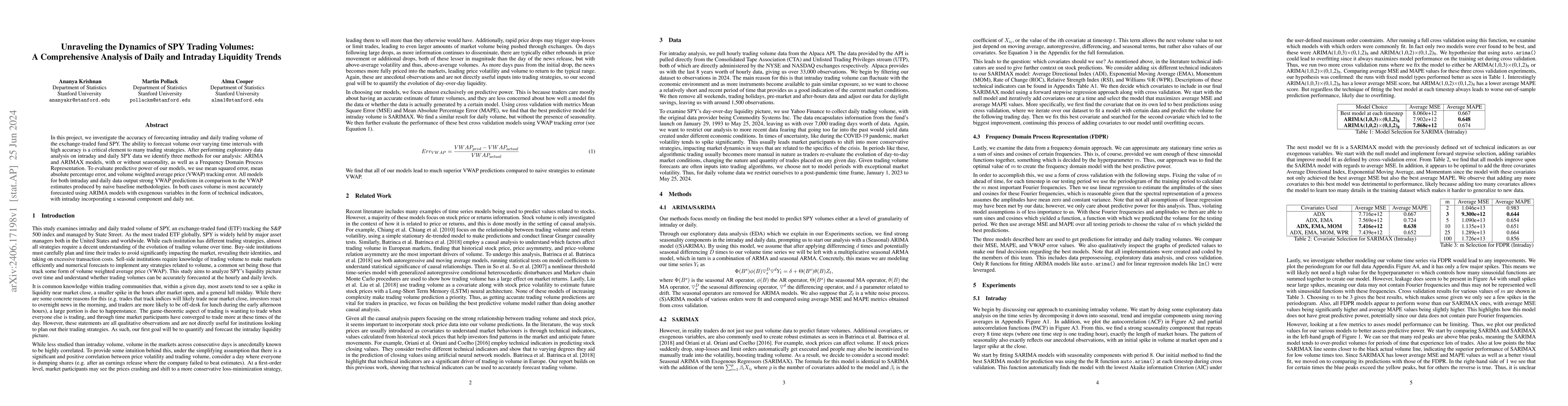

In this project, we investigate the accuracy of forecasting intraday and daily trading volume of the exchange-traded fund SPY. The ability to forecast volume over varying time intervals with high accuracy is a critical element to many trading strategies. After performing exploratory data analysis on intraday and daily SPY data we identify three methods for our analysis: ARIMA and ARIMAX models, with or without seasonality, as well as a Frequency Domain Process Representation. To evaluate predictive power of our models, we use mean squared error, mean absolute percentage error, and volume weighted average price (VWAP) tracking error. All models for both intraday and daily data output strong VWAP predictions in comparison to the VWAP estimates produced by naive baseline methodologies. In both cases volume is most accurately forecasted using ARIMA models with exogenous variables in the form of technical indicators, with intraday incorporating a seasonal component and daily not.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)