Authors

Summary

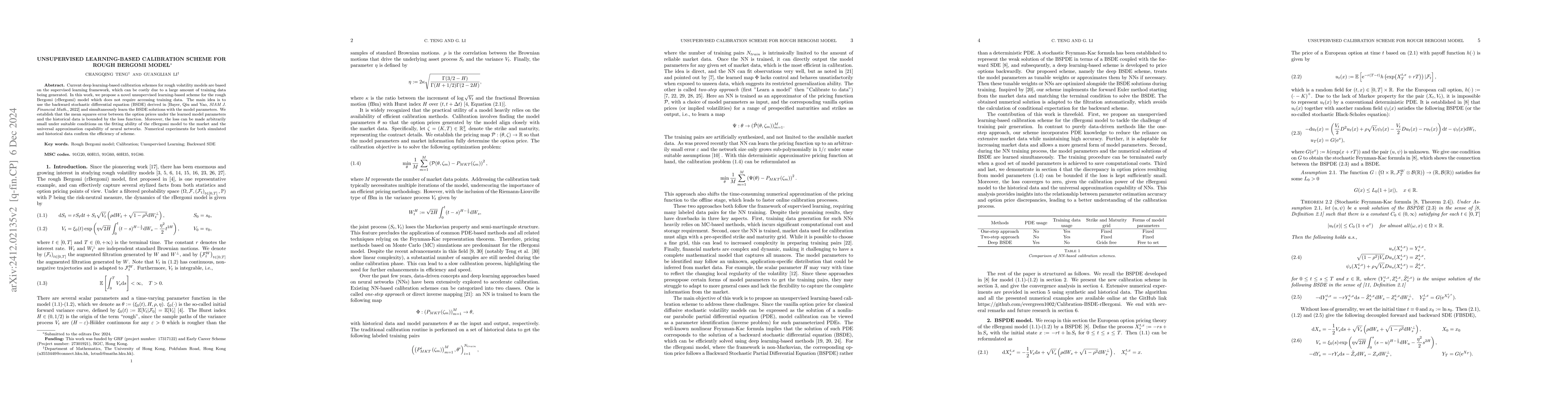

Current deep learning-based calibration schemes for rough volatility models are based on the supervised learning framework, which can be costly due to a large amount of training data being generated. In this work, we propose a novel unsupervised learning-based scheme for the rough Bergomi (rBergomi) model which does not require accessing training data. The main idea is to use the backward stochastic differential equation (BSDE) derived in [Bayer, Qiu and Yao, {SIAM J. Financial Math.}, 2022] and simultaneously learn the BSDE solutions with the model parameters. We establish that the mean squares error between the option prices under the learned model parameters and the historical data is bounded by the loss function. Moreover, the loss can be made arbitrarily small under suitable conditions on the fitting ability of the rBergomi model to the market and the universal approximation capability of neural networks. Numerical experiments for both simulated and historical data confirm the efficiency of scheme.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)