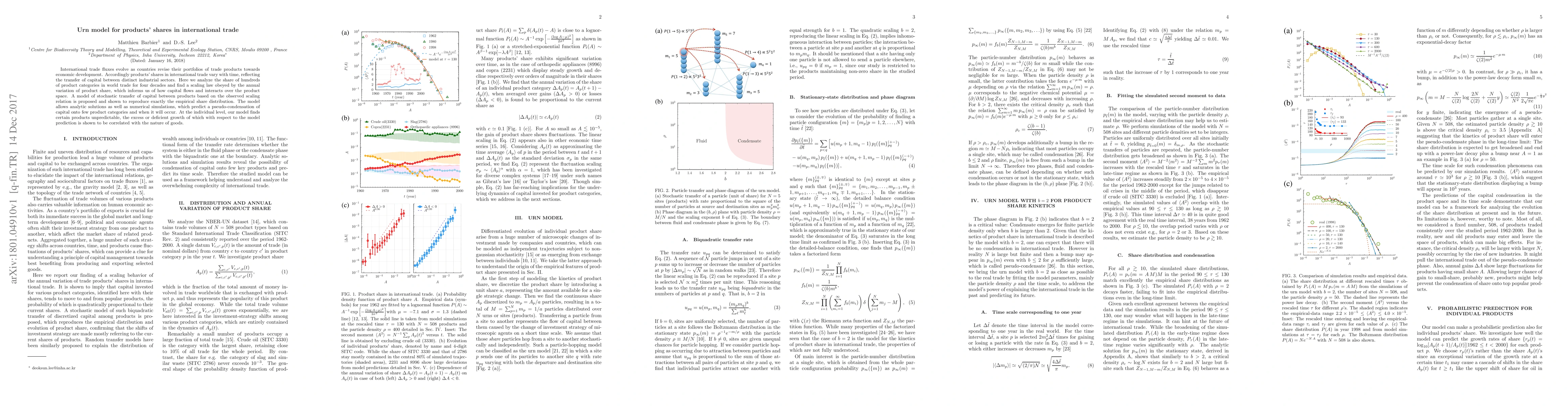

Summary

International trade fluxes evolve as countries revise their portfolios of trade products towards economic development. Accordingly products' shares in international trade vary with time, reflecting the transfer of capital between distinct industrial sectors. Here we analyze the share of hundreds of product categories in world trade for four decades and find a scaling law obeyed by the annual variation of product share, which informs us of how capital flows and interacts over the product space. A model of stochastic transfer of capital between products based on the observed scaling relation is proposed and shown to reproduce exactly the empirical share distribution. The model allows analytic solutions as well as numerical simulations, which predict a pseudo-condensation of capital onto few product categories and when it will occur. At the individual level, our model finds certain products unpredictable, the excess or deficient growth of which with respect to the model prediction is shown to be correlated with the nature of goods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn interpretable machine-learned model for international oil trade network

Wei-Xing Zhou, Na Wei, Wen-Jie Xie

International Trade Flow Prediction with Bilateral Trade Provisions

Caiwen Ding, Jiahui Zhao, Dongjin Song et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)