Authors

Summary

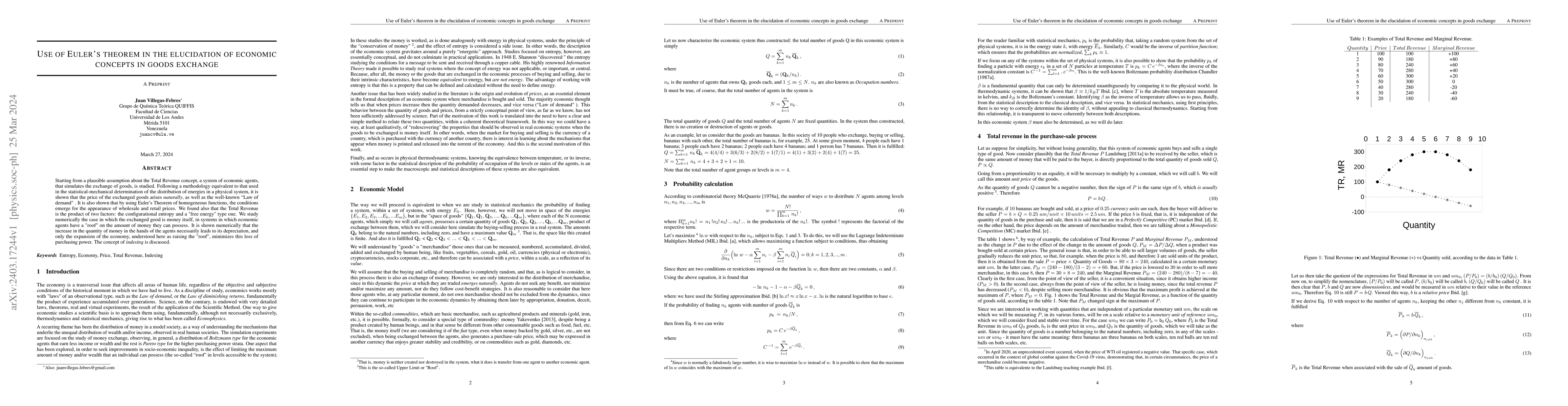

Starting from a plausible assumption about the Total Revenue concept, a system of economic agents, that simulates the exchange of goods, is studied. Following a methodology equivalent to that used in the statistical-mechanical determination of the distribution of energies in a physical system, it is shown that the price of the exchanged goods arises naturally, as well as the well-known ``Law of demand". It is also shown that by using Euler's Theorem of homogeneous functions, the conditions emerge for the appearance of wholesale and retail prices. We found also that the Total Revenue is the product of two factors: the configurational entropy and a "free energy" type one. We study numerically the case in which the exchanged good is money itself, in systems in which economic agents have a "roof" on the amount of money they can possess. It is shown numerically that the increase in the quantity of money in the hands of the agents necessarily leads to its depreciation, and only the expansion of the economy, understood here as raising the "roof", minimizes this loss of purchasing power. The concept of indexing is discussed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)