Authors

Summary

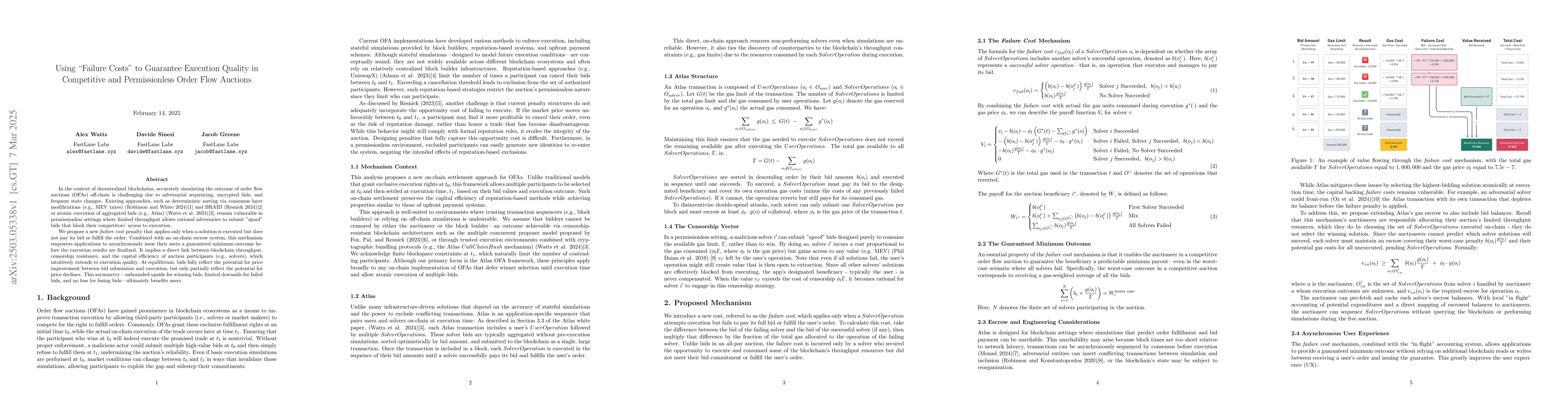

In the context of decentralized blockchains, accurately simulating the outcome of order flow auctions (OFAs) off-chain is challenging due to adversarial sequencing, encrypted bids, and frequent state changes. Existing approaches, such as deterministic sorting via consensus layer modifications (e.g., MEV taxes) (Robinson and White 2024) and BRAID (Resnick 2024) or atomic execution of aggregated bids (e.g., Atlas) (Watts et al. 2024), remain vulnerable in permissionless settings where limited throughput allows rational adversaries to submit "spoof" bids that block their competitors' access to execution. We propose a new failure cost penalty that applies only when a solution is executed but does not pay its bid or fulfill the order. Combined with an on-chain escrow system, this mechanism empowers applications to asynchronously issue their users a guaranteed minimum outcome before the execution results are finalized. It implies a direct link between blockchain throughput, censorship resistance, and the capital efficiency of auction participants (e.g., solvers), which intuitively extends to execution quality. At equilibrium, bids fully reflect the potential for price improvement between bid submission and execution, but only partially reflect the potential for price declines. This asymmetry unbounded upside for winning bids, limited downside for failed bids, and no loss for losing bids - ultimately benefits users.

AI Key Findings

Generated Jun 10, 2025

Methodology

The paper proposes a novel on-chain settlement mechanism for order flow auctions (OFAs) centered around the concept of failure costs, which impose structured penalties on solvers who gain the right to execute but fail to pay their bid, ensuring real consequences for low-quality, manipulative, or obstructive bidding tactics.

Key Results

- The failure cost mechanism strengthens censorship resistance, discourages spam or spoof bids, and guarantees the beneficiary a predictable minimum payout, even under worst-case conditions.

- Participants are led towards a Bayes-Nash equilibrium, where no single solver can profitably deviate from their chosen strategy once the equilibrium is established.

- The mechanism aligns economic incentives, encourages meaningful engagement from solvers, and fosters an environment where quality, reliability, and well-informed bidding become the norm.

Significance

This research is important as it offers a robust theoretical and practical foundation for designing next-generation auction protocols that serve both solvers and end-users more effectively, particularly in the context of decentralized finance and blockchain-based auctions.

Technical Contribution

The paper introduces a novel on-chain settlement mechanism for order flow auctions that incorporates failure costs, ensuring solvers bear real consequences for low-quality bids and promoting responsible bidding behavior.

Novelty

This work differs from existing research by focusing on failure costs as a structured penalty mechanism to enhance censorship resistance, discourage spam bids, and guarantee a predictable minimum payout in competitive and uncertain blockchain environments.

Limitations

- The model assumes solver valuations sampled from X are independent, which in reality, are highly covariant, and solver competition often results in congestion costs reducing overall participant welfare.

- The simplifying assumption that the expectation of solver bids is rank-agnostic may lead to inflated optimal bid values.

Future Work

- Investigating how correlated or varying valuations affect equilibrium bidding behavior, the distribution of failure costs, and the dynamics of censorship resistance would significantly deepen theoretical understanding and practical guidance.

- Exploring the interaction of this asynchronous guarantee with various bridging protocols, liquidity conditions, or complex multi-chain topologies could uncover valuable insights into extending the mechanism's application.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAutobidding Auctions in the Presence of User Costs

Hanrui Zhang, Vahab Mirrokni, Song Zuo et al.

No citations found for this paper.

Comments (0)