Authors

Summary

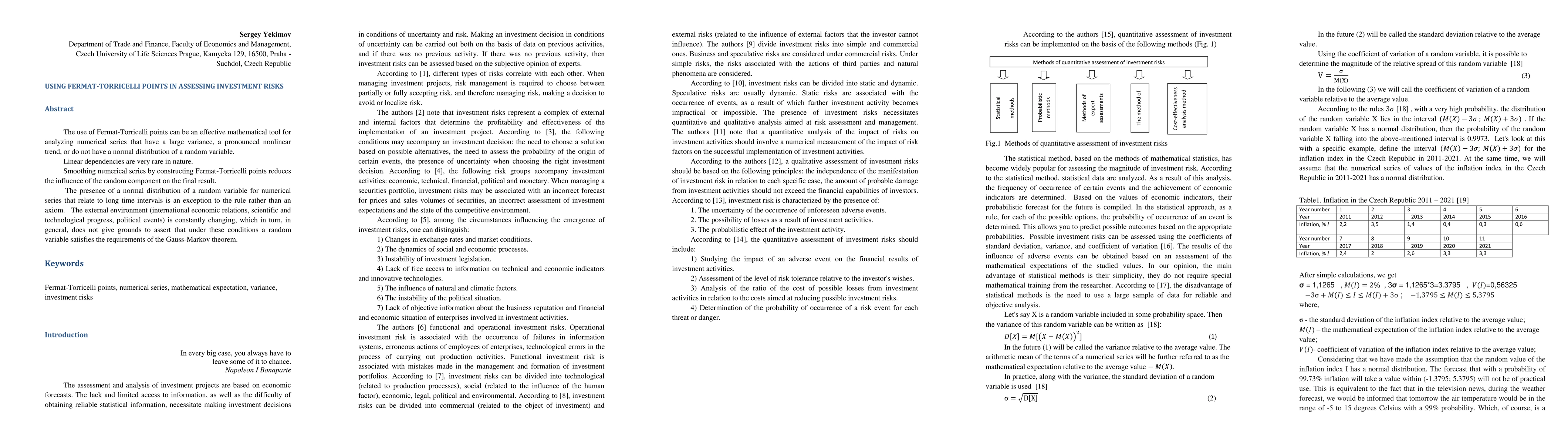

The use of Fermat-Torricelli points can be an effective mathematical tool for analyzing numerical series that have a large variance, a pronounced nonlinear trend, or do not have a normal distribution of a random variable. Linear dependencies are very rare in nature. Smoothing numerical series by constructing Fermat-Torricelli points reduces the influence of the random component on the final result. The presence of a normal distribution of a random variable for numerical series that relate to long time intervals is an exception to the rule rather than an axiom. The external environment (international economic relations, scientific and technological progress, political events) is constantly changing, which in turn, in general, does not give grounds to assert that under these conditions a random variable satisfies the requirements of the Gauss-Markov theorem.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)