Summary

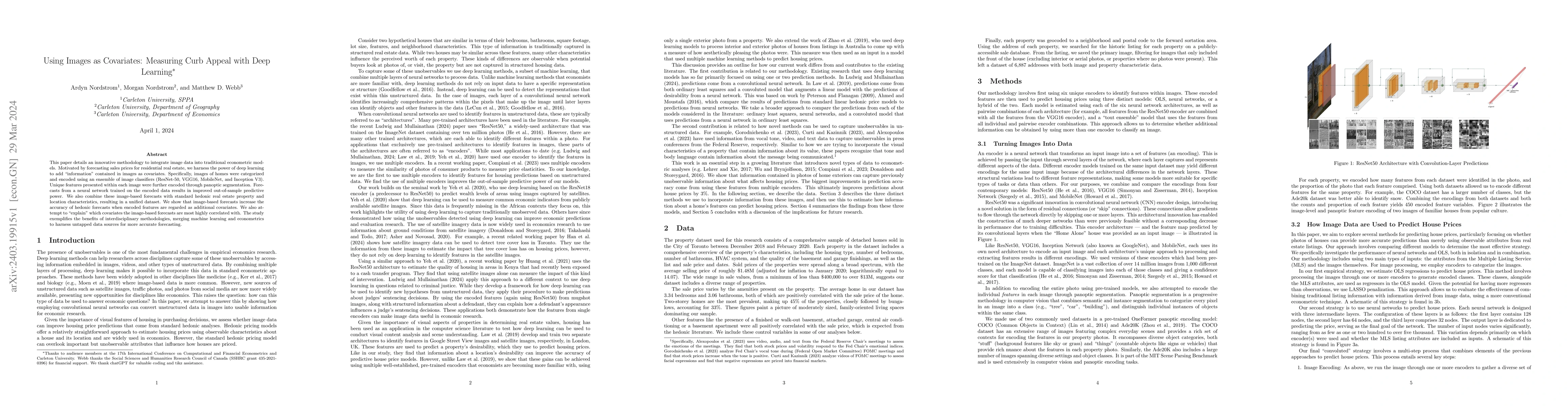

This paper details an innovative methodology to integrate image data into traditional econometric models. Motivated by forecasting sales prices for residential real estate, we harness the power of deep learning to add "information" contained in images as covariates. Specifically, images of homes were categorized and encoded using an ensemble of image classifiers (ResNet-50, VGG16, MobileNet, and Inception V3). Unique features presented within each image were further encoded through panoptic segmentation. Forecasts from a neural network trained on the encoded data results in improved out-of-sample predictive power. We also combine these image-based forecasts with standard hedonic real estate property and location characteristics, resulting in a unified dataset. We show that image-based forecasts increase the accuracy of hedonic forecasts when encoded features are regarded as additional covariates. We also attempt to "explain" which covariates the image-based forecasts are most highly correlated with. The study exemplifies the benefits of interdisciplinary methodologies, merging machine learning and econometrics to harness untapped data sources for more accurate forecasting.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAppeal prediction for AI up-scaled Images

Steve Göring, Alexander Raake, Rasmus Merten

Enhancing Underwater Images Using Deep Learning with Subjective Image Quality Integration

Jose-Luis Lisani, Jose M. Montero

No citations found for this paper.

Comments (0)