Summary

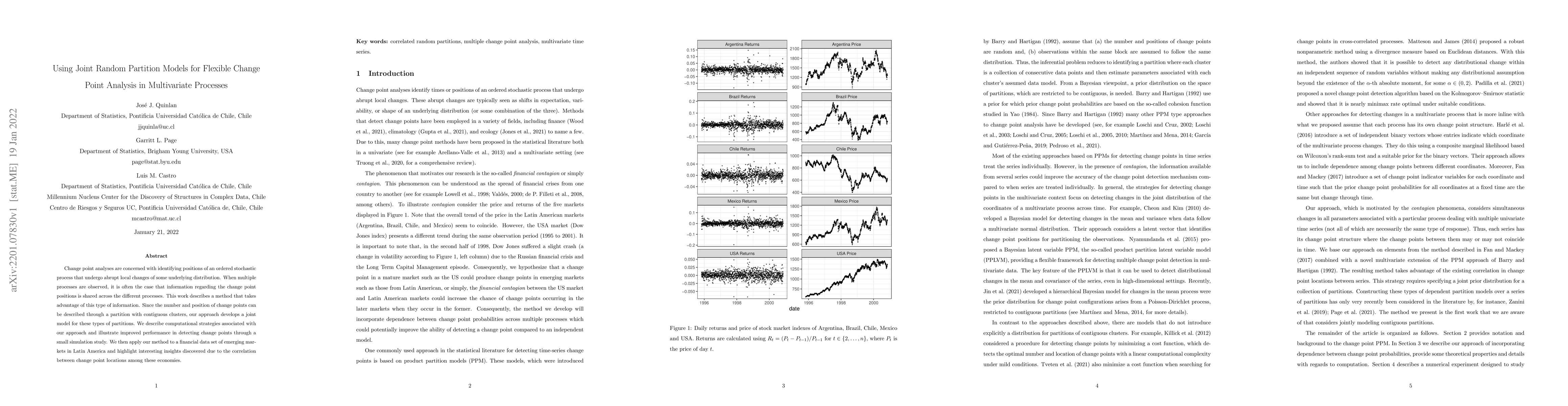

Change point analyses are concerned with identifying positions of an ordered stochastic process that undergo abrupt local changes of some underlying distribution. When multiple processes are observed, it is often the case that information regarding the change point positions is shared across the different processes. This work describes a method that takes advantage of this type of information. Since the number and position of change points can be described through a partition with contiguous clusters, our approach develops a joint model for these types of partitions. We describe computational strategies associated with our approach and illustrate improved performance in detecting change points through a small simulation study. We then apply our method to a financial data set of emerging markets in Latin America and highlight interesting insights discovered due to the correlation between change point locations among these economies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFlexible joint models for multivariate longitudinal and time-to-event data using multivariate functional principal components

Sonja Greven, Nikolaus Umlauf, Alexander Volkmann

A change-point problem for $m$-dependent multivariate random field

Vitalii Makogin, Duc Nguyen

Random Forests for Change Point Detection

Peter Bühlmann, Malte Londschien, Solt Kovács

No citations found for this paper.

Comments (0)