Summary

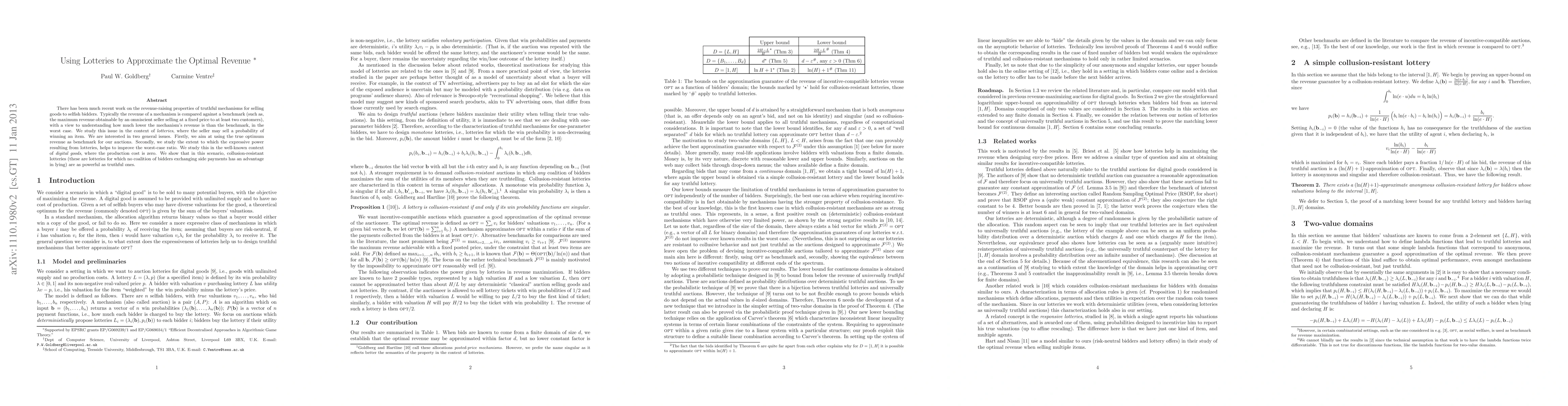

There has been much recent work on the revenue-raising properties of truthful mechanisms for selling goods to selfish bidders. Typically the revenue of a mechanism is compared against a benchmark (such as, the maximum revenue obtainable by an omniscient seller selling at a fixed price to at least two customers), with a view to understanding how much lower the mechanism's revenue is than the benchmark, in the worst case. We study this issue in the context of {\em lotteries}, where the seller may sell a probability of winning an item. We are interested in two general issues. Firstly, we aim at using the true optimum revenue as benchmark for our auctions. Secondly, we study the extent to which the expressive power resulting from lotteries, helps to improve the worst-case ratio. We study this in the well-known context of {\em digital goods}, where the production cost is zero. We show that in this scenario, collusion-resistant lotteries (these are lotteries for which no coalition of bidders exchanging side payments has an advantage in lying) are as powerful as truthful ones.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNew Guarantees for Learning Revenue Maximizing Menus of Lotteries and Two-Part Tariffs

Maria-Florina Balcan, Hedyeh Beyhaghi

Reconfiguration and Enumeration of Optimal Cyclic Ladder Lotteries

Yuta Nozaki, Kunihiro Wasa, Katsuhisa Yamanaka

A Lagrangian Approach to Optimal Lotteries in Non-Convex Economies

Yucheng Yang, Zhennan Zhou, Chengfeng Shen et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)