Summary

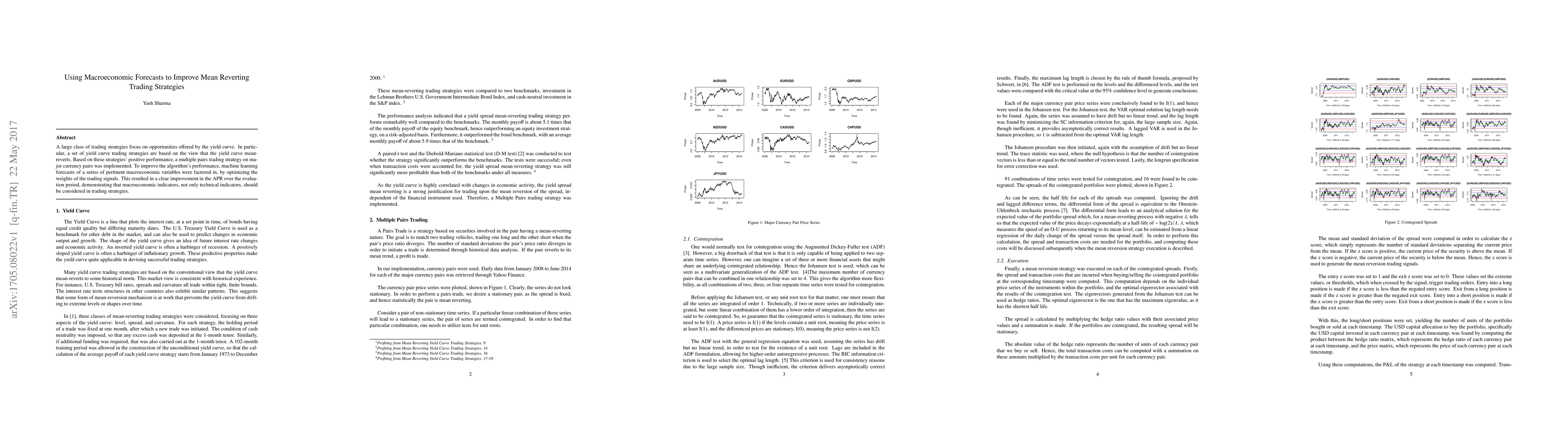

A large class of trading strategies focus on opportunities offered by the yield curve. In particular, a set of yield curve trading strategies are based on the view that the yield curve mean-reverts. Based on these strategies' positive performance, a multiple pairs trading strategy on major currency pairs was implemented. To improve the algorithm's performance, machine learning forecasts of a series of pertinent macroeconomic variables were factored in, by optimizing the weights of the trading signals. This resulted in a clear improvement in the APR over the evaluation period, demonstrating that macroeconomic indicators, not only technical indicators, should be considered in trading strategies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)