Authors

Summary

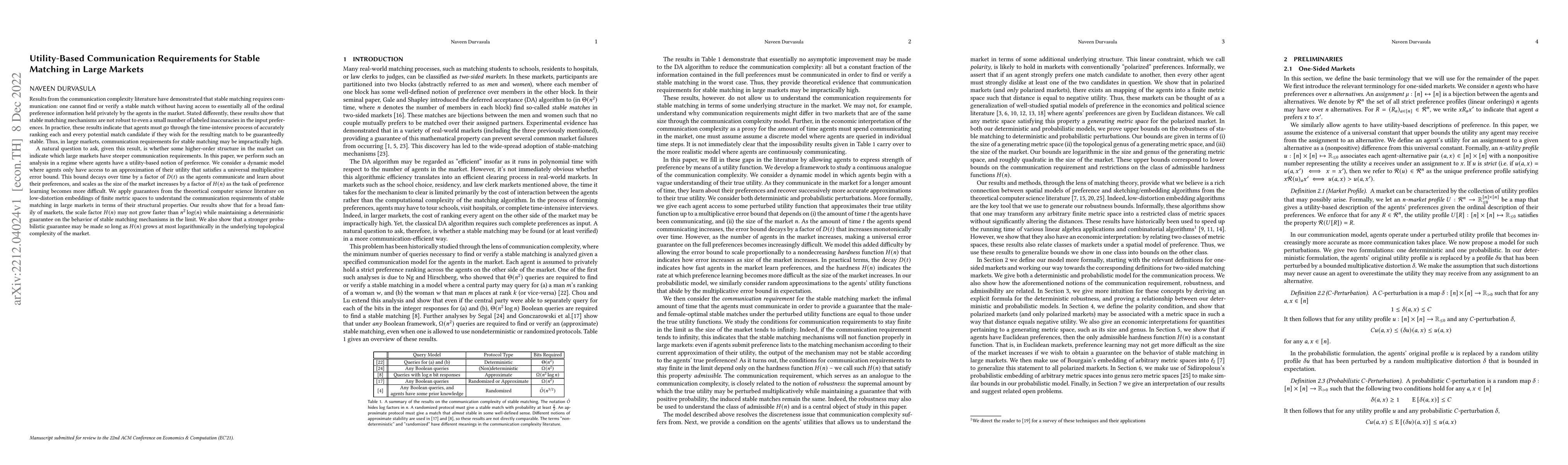

Results from the communication complexity literature have demonstrated that stable matching requires communication: one cannot find or verify a stable match without having access to essentially all of the ordinal preference information held privately by the agents in the market. Stated differently, these results show that stable matching mechanisms are not robust to even a small number of labeled inaccuracies in the input preferences. In practice, these results indicate that agents must go through the time-intensive process of accurately ranking each and every potential match candidate if they wish for the resulting match to be guaranteedly stable. Thus, in large markets, communication requirements for stable matching may be impractically high. A natural question to ask, given this result, is whether some higher-order structure in the market can indicate which large markets have steeper communication requirements. In this paper, we perform such an analysis in a regime where agents have a utility-based notion of preference. We consider a dynamic model where agents only have access to an approximation of their utility that satisfies a universal multiplicative error bound. We apply guarantees from the theoretical computer science literature on low-distortion embeddings of finite metric spaces to understand the communication requirements of stable matching in large markets in terms of their structural properties. Our results show that for a broad family of markets, the error bound may not grow faster than $n^2\log(n)$ while maintaining a deterministic guarantee on the behavior of stable matching mechanisms in the limit. We also show that a stronger probabilistic guarantee may be made so long as the bound grows at most logarithmically in the underlying topological complexity of the market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProbabilistic Analysis of Stable Matching in Large Markets with Siblings

Makoto Yokoo, Zhaohong Sun, Tomohiko Yokoyama

Two-Sided Manipulation Games in Stable Matching Markets

Hadi Hosseini, Grzegorz Lisowski, Shraddha Pathak

Decentralized, Communication- and Coordination-free Learning in Structured Matching Markets

Eric Mazumdar, Chinmay Maheshwari, Shankar Sastry

No citations found for this paper.

Comments (0)