Summary

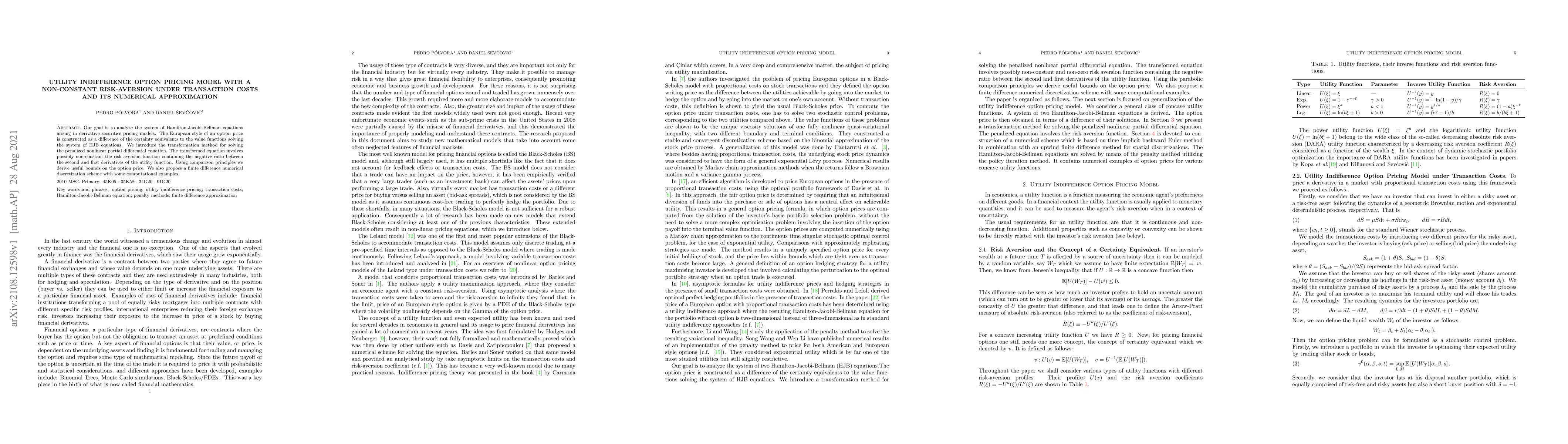

Our goal is to analyze the system of Hamilton-Jacobi-Bellman equations arising in derivative securities pricing models. The European style of an option price is constructed as a difference of the certainty equivalents to the value functions solving the system of HJB equations. We introduce the transformation method for solving the penalized nonlinear partial differential equation. The transformed equation involves possibly non-constant the risk aversion function containing the negative ratio between the second and first derivatives of the utility function. Using comparison principles we derive useful bounds on the option price. We also propose a finite difference numerical discretization scheme with some computational examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)